Stanislas Pottier discusses mainstreaming ESG and social inclusion through investment

Ahead of the Sustainable Investment Forum Europe, taking place in Paris on the 12th March 2019, we caught up with Stanislas Pottier to discuss mainstreaming ESG and social inclusion through investment.

Ahead of the Sustainable Investment Forum Europe, taking place in Paris on the 12th March 2019, we caught up with Stanislas Pottier, Chief Responsible Investment Officer at Amundi, to discuss mainstreaming ESG and social inclusion through investment.

Can you describe the key drivers of your responsible investment strategy?

Responsible Investment has been a fundamental pillar at Amundi since its creation in 2010. Today, Amundi manages €1 425 billion of assets from which €276 billion in a responsible way, representing 19 % of its total assets under management.

As a financial player, we consider we have a leading role to play for a more sustainable world, we do so through 4 key drivers. Firstly through our investment policy and processes, by ensuring we manage our portfolio in a responsible way thanks to a thorough ESG integration and analysis. Secondly through our engagement towards companies. As asset managers we use our influence on issuers’ to improve their ESG practices through active dialogue, engagement for influence and voting policies. Thirdly, through a strong product offering by proposing a large range of solutions that meet the diverse needs and objectives of our clients. Our responsible offer is adapted to various asset classes, geographical issues, financial strategies… Our final key driver is our advisory capabilities. Amundi plays a leading role in advising companies in the design and implementation of responsible investment.

All 4 drivers have enabled Amundi to place itself as leader in Responsible Investment .

How is Amundi mainstreaming ESG across your business and asset classes?

As I already mentioned, ESG has been at the heart of Amundi’s ambition since the very beginning.

In this regard Amundi currently has €276 billion RI assets invested through three axes, as follows:

- Applying ESG criteria in addition to traditional financial analysis. A dedicated Amundi team gives (more than 5,500) issuers an ESG rating from A to G (A being the best, G the worst rating). This rating may mean certain stocks are over weighted or underweighted in portfolios, or excluded completely. It gives company managements the incentive to improve their environmental and social impact. Assets under management incorporating this policy represent €267 billion.

- €8 billion of funds with targeted investments, particularly to tackle climate change or finance energy transition. Examples include €3 billion invested in low-carbon index funds in partnership with MSCI, €2 billion invested in green bonds, largely from emerging countries in partnership with the World Bank, and around €500 million invested in energy transition through a JV with EDF.

- Support for social and solidarity economy companies through a dedicated €200 million fund.

Amundi also applies a targeted exclusion policy to a majority of its portfolios. Amundi excludes from all its active management companies that do not comply with its ESG policy, with international conventions and frameworks, or with national regulations (controversial weapons …). Specific exclusion policies are also applied in the tobacco or coal mining sectors. Amundi can furthermore apply specific exclusions on demand from clients.

Amundi announced in October 2018 an ambitious action plan to mainstream its Responsible Investment and become 100% ESG in its rating, fund management and voting policy by 2021.

For all actively managed funds it will be required that their ESG rating is better than the ESG rating of their benchmark index. ESG investments with passive management are to be massively expanded. To this end, a new SRI-ETF range has already been launched. The "Ambition 2021" action plan underscores Amundi's commitment as a responsible investor.

Social issues are increasingly emerging on the agenda of sustainable finance experts. How can you as a major investor address social inclusion and injustices through your investments?

The world is evolving, issues that were yesterday strictly undertaken by public authorities are today often held partly by the private sector. Through their investments, asset managers and investors can support and maintain social (and environmental) projects. As shareholders, we hold the responsibility and, importantly, the power to pursue objectives of general interest, not only linked to pure financial return. Investors can play this key role by encouraging companies to address sustainable development issues through engagement policies. Going further, investors can strengthen these actions by supporting international collective initiatives that promote sustainability globally and gather actors from the financial sector.

As part of our 2021 Action plan, Amundi is committed to integrate all ESG issues at the same level in our voting policy at General Assembly Meetings and highlight topical issues. As an example, as of 2019 particular attention will be drawn towards the control of wage balance within the framework of compensation policies.

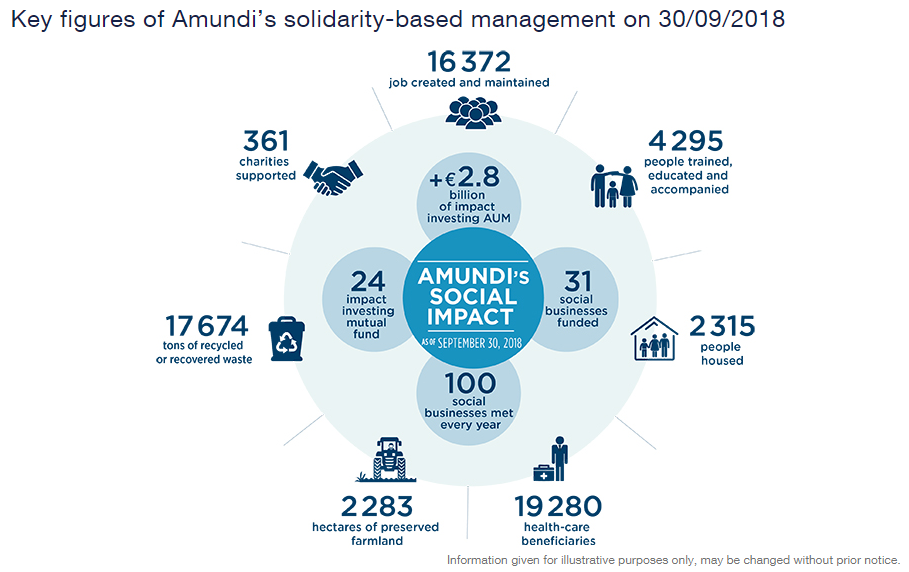

Find below, a few numbers to illustrate Amundi’s social impact:

What are you hoping to get out of the forum -- what kind of discussions are needed to drive sustainable investment forward?

We have been partners of this event for a number of years now. It is clear that, as a responsible financial actor, we have to take part in global events in order to exchange and discuss today’s ESG issues and the turn that is taking responsible investment.

One strong challenge today for portfolio managers is to adapt their ESG investment strategy to different markets and ethical cultures. Specific social rules may vary from one country to another. These events, which gather financial players from various countries, are the opportunity to discuss today’s and tomorrow’s challenges with investors from all regions in the world. Such events are also an opportunity for discussing investors’ needs and wants globally to offer always well adapted products and services.

Amundi is a Gold Sponsor at the Sustainable Investment Forum Europe, taking place on 12 March 2019, find out more here.

Visit Amundi's website here.