Whitepaper looks at the risk impact of incorporating SDG exposure into portfolios

What can investors expect when building portfolios that incorporate SDGs? A new Qontigo whitepaper compares optimized single SDG, two SDG and all SDG portfolios across a number of different risk-related dimensions.

.png)

Want to incorporate SDG exposures into your portfolios? There’s no such thing as a (risk) free lunch, but here’s a way to do it…

In a new Qontigo whitepaper, the research team used end-of-year 2021 data from the Sustainable Development Investments Asset Owner Platform (SDI AOP) to run simple optimizations with the objective of maximizing exposure (defined by the percent of revenue) to one, two or all SDGs. The STOXX® Global 1800 Index was used as the investment universe and benchmark. The only constraints employed were to be fully invested with a 3% target tracking error. The research team created four active portfolios.

Maximize exposure to:

- All SDGs

- SDG-3 (Good Health and Well Being)

- SDG-7 (Affordable and Clean Energy)

- A combination of SDG-6 and SDG-13 (Clean Water and Sanitation & Climate Action)

The STOXX Global 1800: well-diversified with some SDG exposure, but much more exposure was possible

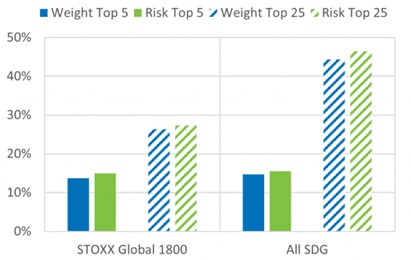

The STOXX® Global 1800 Index by definition holds 1800 names, but the effective number of names at the end of 2021 was 1563, with 13.7% of the weight and almost 15% of the risk in the top five names, and just over a quarter of the weight and 27.3% of the risk in the top 25 (Exhibit 1). The portfolio designed to maximize exposure to all SDGs, in contrast to the STOXX® Global 1800, held 170 names, with an effective number of names of 89. The top-five weight was similar to that of the index, but the All-SDG portfolio was significantly more concentrated in the top 25 names.

Exhibit 1. Weight and Contribution to Risk, Top 5 and Top 25 Holdings, STOXX Global 1800 vs. All-SDG Portfolio

Source: SDI AOP, Qontigo

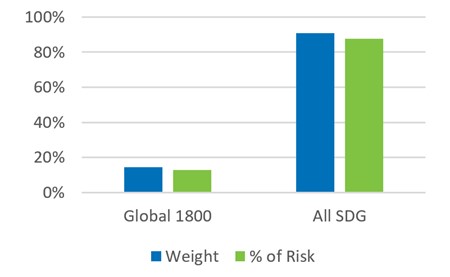

SDG exposure was not completely absent from the index, although it was relatively muted (Exhibit 2): 14% of the index weight met at least one Sustainable Development Goal. Another interesting note is that the percent of total portfolio risk in the index exposed to the “All SDG” category was lower than its weight, suggesting that companies meeting SDG criteria were also less risky than other names on average. Of course, the All-SDG portfolio had a much higher weight than the Global 1800 devoted to meeting one or more the SDGs (91%), and the contribution to risk of those names was also lower than the weight.

Exhibit 2. Weight and Contribution to Risk, All SDGs, STOXX Global 1800 vs. All-SDG Portfolio

Source: SDI AOP, Qontigo

Of course, SDG exposure came with some additional risk exposures

The optimized portfolio came with some active factor exposures as well as with stock-specific risk. About half of the All-SDG portfolio’s 3% tracking error was factor-based, with the other half stock-specific. In addition, most of the factor risk was Industry risk, with a little style risk as well.

The All-SDG portfolio had a big overweight in Health Care, offset by underweights in Financials and Info Tech, driving the industry risk. It also had a small-cap and low Dividend Yield bias. Other style exposures were relatively small. It had a big country underweight in US exposure, although country exposures contributed less than 2% of the active risk.

Finally, the team found that the All-SDG portfolio got much of its exposure from SDG-3, “Good Health and Well Being” (hence the Health Care overweight), although a few of the other SDGs also contributed. As noted earlier, while the contribution to overall risk from the SDGs was lower than what would be expected given their weight, that was not the case for some of the individual SDGs. For example, those companies meeting SDG-7, “Affordable and Clean Energy”, were riskier than the universe and therefore contributed more to the total risk.

SDG-3, SDG-7 and combination SDG-6 and SDG-13 portfolios

To read the analysis of the single and two SDG portfolios, please download Qontigo’s whitepaper.

About Qontigo

Qontigo is a leading global provider of innovative index (STOXX and DAX), analytics and risk solutions that optimize investment impact. As the shift toward sustainable investing accelerates, Qontigo enables its clients—financial-products issuers, asset owners and asset managers—to deliver sophisticated and targeted solutions at scale to meet the increasingly demanding and unique sustainability goals of investors worldwide.

Part of the Deutsche Börse Group, Qontigo was created in 2019 through the combination of Axioma, DAX and STOXX. Headquartered in Eschborn, Germany, Qontigo’s global presence includes offices in New York, London, Zug and Hong Kong.