Sustainable investment: The new normal matures

For the seventh year in a row, FTSE Russell asked global asset owners for their views and practices across a range of sustainable investment issues: 350 asset owners participated with combined assets under management (AUM) of between $7.9trn-$14.2trn.

For the seventh year in a row, FTSE Russell asked global asset owners for their views and practices across a range of sustainable investment issues: 350 asset owners participated with combined assets under management (AUM) of between $7.9trn-$14.2trn.

Tony Campos, Head of Sustainable Investment, Index Investments Group at FTSE Russell comments: “Our latest survey takes an in depth look at the priorities, challenges, and opportunities within sustainable investment for asset owners globally. It continues to emphasise the importance of sustainable investment for asset owner strategies, and after five years of steady growth, sustainable investment continues to mature. Although the survey shows a directional dip in adoption, more than three in four respondents are implementing and evaluating sustainable investment, which reflects how established the topic is for asset owners.”

Sustainable investment continues to mature

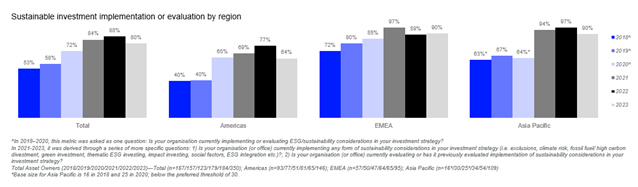

Following five years of steady growth there has been a directional dip to 80% this year from 88% in 2022 in the level of asset owners globally that are implementing and evaluating sustainable investment. Though not a significant change, this dip can be attributed to influential macroeconomic factors, such as high interest rates to combat inflation, and geopolitical volatility caused by the war in Ukraine. Despite short-term influences on sentiment toward sustainable investment, respondents maintain long-term conviction for this continually maturing investment theme.

To illustrate the maturing investment theme, this year’s research shows an equal number (73%) of asset owners are implementing passive and active sustainable investment strategies, further highlighting the mainstream characteristics of sustainable investment being part of the flight to passive investment strategies.

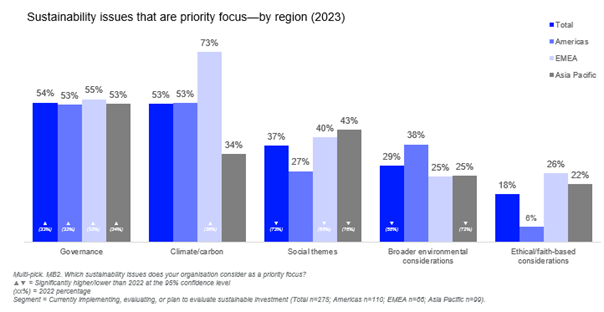

Governance is a priority that has significantly risen across all regions

Our research has highlighted a notable increase in the priority of governance to asset owners this year compared to last. Governance is likely to continue as a priority focus area going forward, which is also a supportive trend for the maturing sustainable investment theme in general.

Certain pressures on asset owners appear to be more complex as the sustainable investment industry matures

Some asset owner priorities are included in their investment strategies. Governance is, but social and broader environmental themes are less so, highlighting that asset owners need to make more provisions so their investment strategies are more inclusive and representative of their priorities. Perceived barriers do exist particularly because of lack of data quality (58% of respondents identified that as a challenge to meet regulatory requirements). In parallel, asset owners are identifying areas that can be resolved, such as by accessing the right, high-quality data and choosing effective data partners.

The asset owner community remains committed to their maturing sustainable investment strategies. This commitment is despite challenging short-term macroeconomic and geopolitical factors that have understandably weighed on asset owner sentiment, causing a directional dip this year in terms of evaluating and implementing their sustainable investment strategies.

For more information, please see FTSE Russell’s Sustainable Investment: 2023 global survey findings from asset owners.