How is corporate ESG data impacting capital flows?

As capital floods into sustainable finance products and strategies, companies are finding themselves assessed by investors against a whole range of novel performance indicators.

As capital floods into sustainable finance products and strategies, companies are finding themselves assessed by investors against a whole range of novel performance indicators. This trend is driving a shift towards a common language on ESG investment, and, also challenging market participants and data provider on materiality. Environmental, social and governance (ESG) metrics can dictate under- or overweighting in indexes or portfolios, or even the inclusion or exclusion from an investable universe. The incorporation of ESG factors into investment strategies is shifting capital away from poor ESG performers towards their better performing peers.

However, there is often a lack of understanding among many companies as to how their sustainability practices and performance, whether disclosed or estimated by an analyst, flows through to the investment strategy or index. Most companies have very little idea how the sustainability data they publish is harvested, aggregated and deployed by investors to influence capital allocation and hence investment flows.

For large, listed companies, the most visible interaction with the financial sector is via sell-side analysts. For these companies, such analysts can become the prism through which they understand all investor assessments of their corporate performance. Their analysis may use some "black box" methodologies, but they will typically explain to their audience of institutional investors how they have come to a view on each company’s sustainability performance, and how it impacts their evaluation of a company’s prospects.

However, companies are often unclear about how assessments of their sustainability performance are made which can impact to what extent they are represented in quant funds and passive portfolios. Such pools of capital represent a large and growing proportion of global investment portfolios

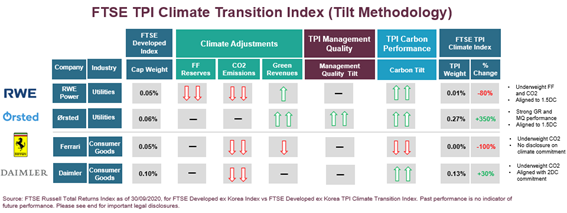

To help address this, we thought it might be useful to show how sustainability factors influence the weighting of four illustrative companies in a popular FTSE Russell climate-tilted index, the FTSE TPI Climate Transition Index. Climate-adjusted index funds represent one of the most rapidly growing areas of investment management as investors switch to these from more conventional benchmarks. Although we discuss here the specific approach taken by this index, it is similar to those taken by a growing number of investment strategies that seek to track a benchmark while increasing exposure to better sustainability performers while reducing exposure to laggards.

The index is created in partnership with the Transition Pathway Initiative (TPI), which is a global, asset-owner led initiative that assesses companies' preparedness for the transition to a low-carbon economy. The index applies a variety of climate parameters to modify the weights of companies in the index based on their climate credentials.

The specific FTSE TPI index explained here takes the constituents of the FTSE Developed Index and assesses each company against five metrics. The first three are their fossil fuel reserves, their carbon emissions (both of which are normalized against revenues), and the percentage of their revenues generated by green products or services.

The last two are assessments undertaken in partnership with the TPI: of the company’s climate management quality, which is based upon factors such as climate reporting and governance, including emissions reduction target-setting and climate-linked remuneration; and of its carbon performance, that is, whether its targets are in line with international emissions goals.

These metrics are used to alter the weighting of each company in the benchmark index. The diagram below sets this out for four companies to clarify how this works in practice.

Take two companies in the Utilities sector. Germany’s RWE, with its large coal-fired power fleet, scores poorly on fossil fuel reserves and CO2 emissions. Its relatively small wind and solar fleet gives it a limited uplift from green revenues. A moderately good management quality score is outweighed by targets that are not aligned with what are needed to meet the Paris Agreement goals.

The upshot? RWE’s weighting of 0.05% in the FTSE Developed Index is reduced to 0.01% in the FTSE TPI Climate Index, an 80% reduction.

Denmark’s Ørsted, meanwhile, has successfully transitioned over the past two decades, from an energy company based on coal and oil (formally known as Dong Energy) to a global leader in renewables. Its high proportion of green revenues and strong TPI scores means its weighting is increased by 350%, from 0.06% in the benchmark to 0.27% in the climate index.

Ferrari and Daimler provide an analogous example in the auto sector. The Italian luxury car maker scores poorly on CO2 emissions (from its operations) and has limited green revenues compared with its peers. It also scores poorly on both TPI scores. As with RWE, the scores lead to a zero weighting in the climate index.

Daimler does significantly better. A poor score on CO2 emissions and low green revenues are offset by positive TPI assessments of carbon performance linked to its future targets set for vehicle emissions. The result is an increase in its weighting by 30% in the benchmark to the FTSE TPI Climate Transition Index.

These examples show how sustainability metrics can be applied through a transparent, rules-based methodology to deliver a quantitatively driven outcome. As the volumes of investment managed with a sustainability or climate lens grow, how corporate data is created, analyzed and deployed will have a growing influence on capital flows. It is important, therefore, that companies understand these processes as they may significantly influence their cost of capital. Hold onto your seats, engagement between companies and investors is set to intensify.

To learn more about FTSE Russell click here.

© 2021 London Stock Exchange Group plc (the “LSE Group”). All information is provided for information purposes only. Such information and data is provided “as is” without warranty of any kind. No member of the LSE Group make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of FTSE Russell products or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance. No member of the LSE Group provide investment advice and nothing contained in this document or accessible through FTSE Russell products should be taken as constituting financial or investment advice or a financial promotion. Use and distribution of the LSE Group data requires a licence from an LSE Group company and/or their respective licensors.