How can investors use water metrics to enhance investment returns?

As more investors focus on sustainability, companies are increasing their reporting of water management and risks. How can investors use water metrics to enhance sustainable reporting?

As more investors focus on sustainability, companies are increasing their reporting of water management and risks. How can investors use water metrics to enhance sustainable reporting?

The Sustainable Finance Disclosure Regulation (SFDR) covers water as an investment risk. This should come as no surprise, as the World Economic Forum in 2015 named water availability as the “top global risk”.

Climate change, of course, is a huge factor in water issues, from record droughts in one area to more-frequent and extreme hurricanes and typhoons in another.

Other factors include the world’s population stresses on sources of fresh water, deterioration of water quality due to pollution, effects on aquatic species and food supplies, water needed for world energy production and the effect on human life of inadequate and polluted water.

Risks caused by water insecurity

In 2019, 45 percent of companies that report to investors or customers reported exposure to substantive risks from water insecurity – risks that threaten their reputation and licence to operate, the security of their supply chains, financial stability and their ability to grow, according to the CDP Water Report.

Given the essential quality of water to human and economic life, investors are assessing water metrics in their decision-making process. Industries that depend heavily on dependable water supplies include food companies, energy and mining firms, textile makers and technology manufacturers.

What is the SFDR?

The EU’s SFDR aims to introduce disclosure standards for financial market participants, advisers, and products. The regulation requires all EU-based financial market participants to disclose ESG issues, however it is also expected to shift focus toward sustainability-aware companies as the receivers of investment, or investees.

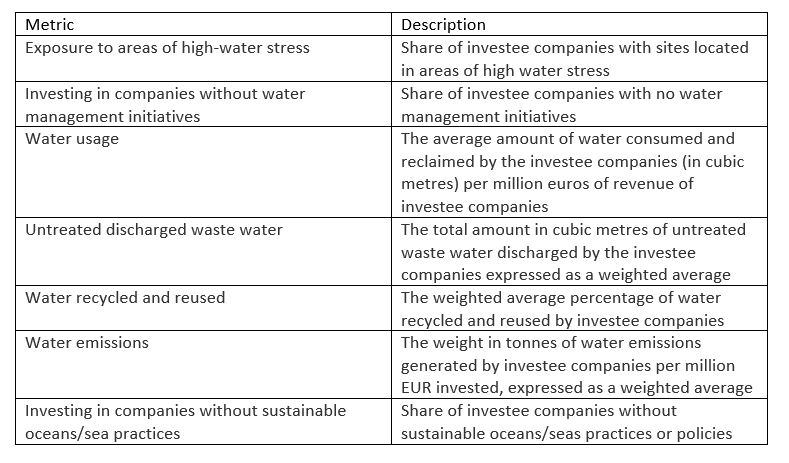

Within the SFDR’s categories, a subset of reporting factors relates to water:

Insights from the ESG database

For investors who must meet the SFDR, one of the main challenges is that corporate disclosure on water metrics does not match the level of disclosure on emissions.

Water disclosure – trickling in

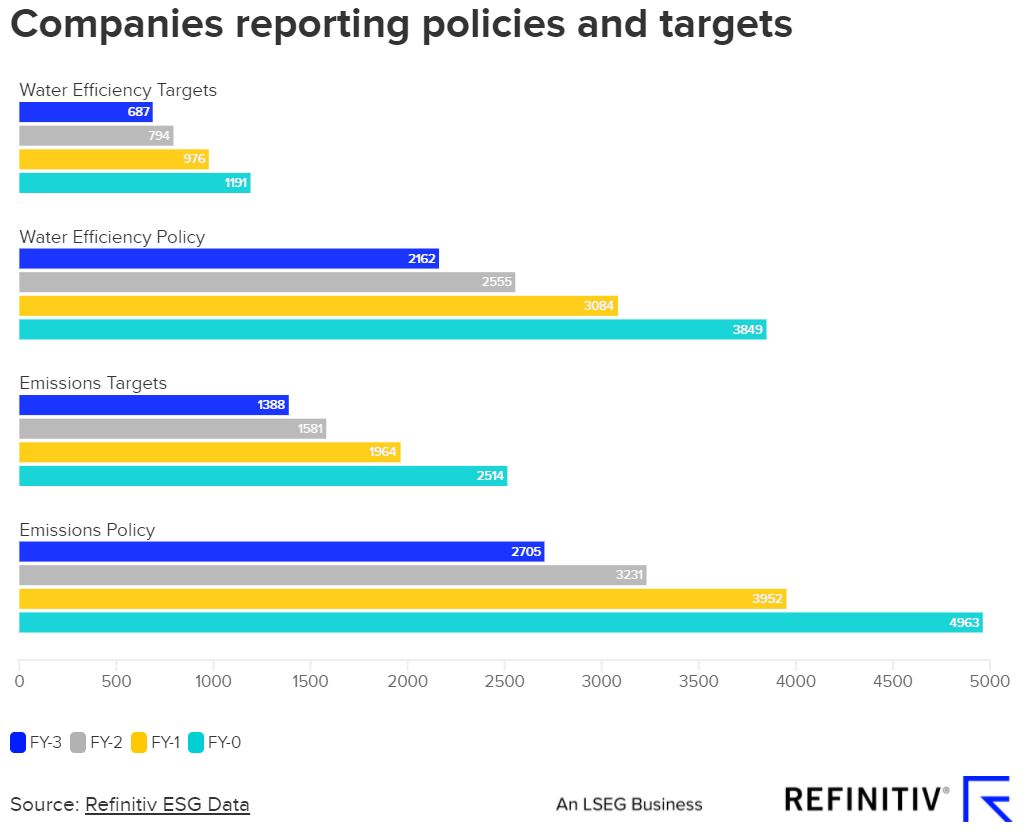

The Refinitiv ESG database reflects that increasing amounts of companies are reporting on our 10 water metrics. For those water metrics related to the SFDR, we have seen an impressive increase in the amount of companies disclosing over the last four years.

Is water withdrawal worth it?

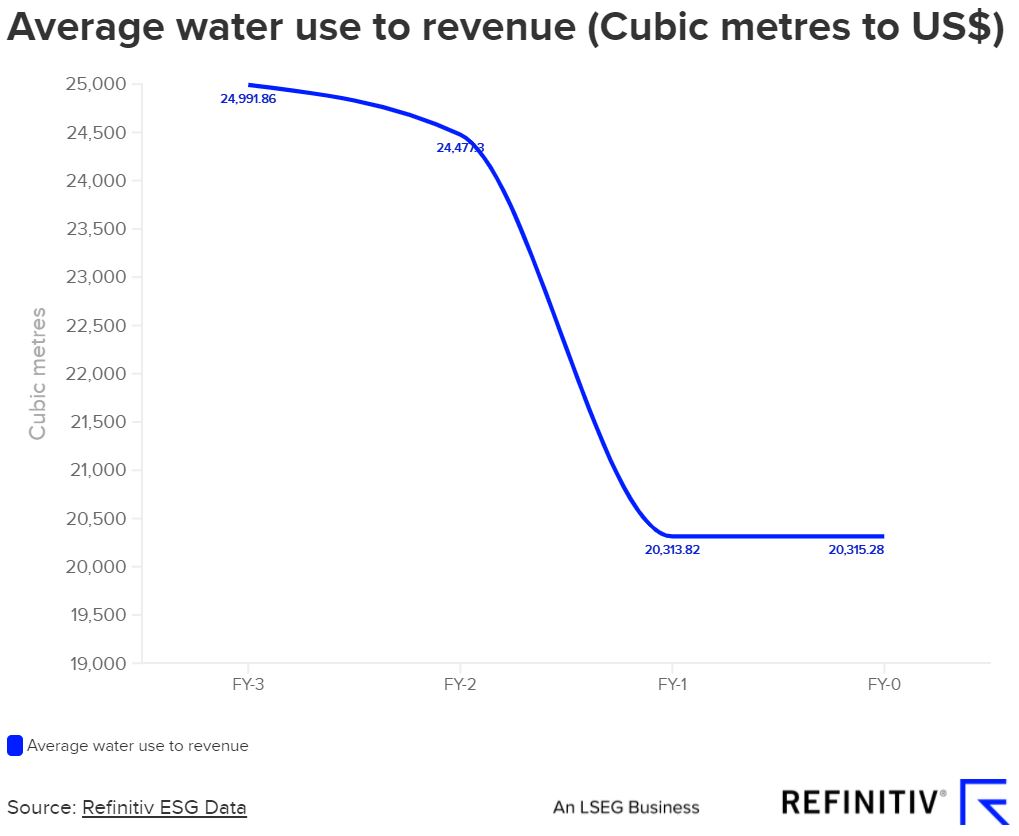

In the database, we measure the total water withdrawal in cubic metres divided by net sale or revenue in U.S. dollars in millions. We have found that for every US$ made, the amount of water used has decreased over the last four years.

A water-intensive industry view

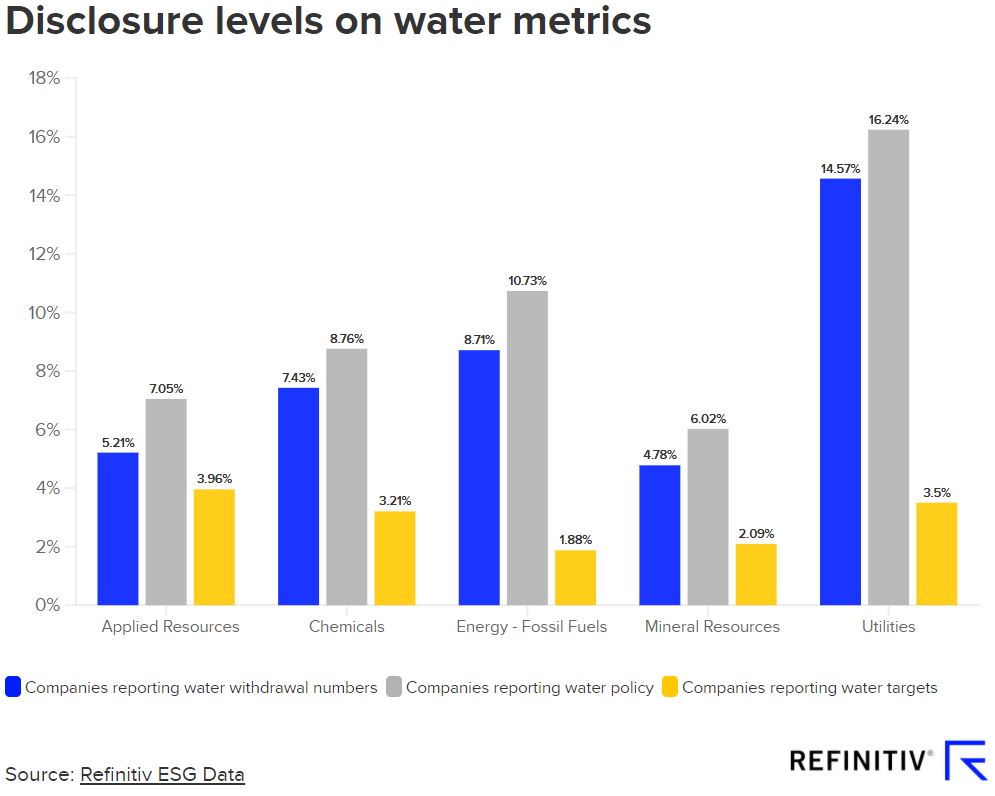

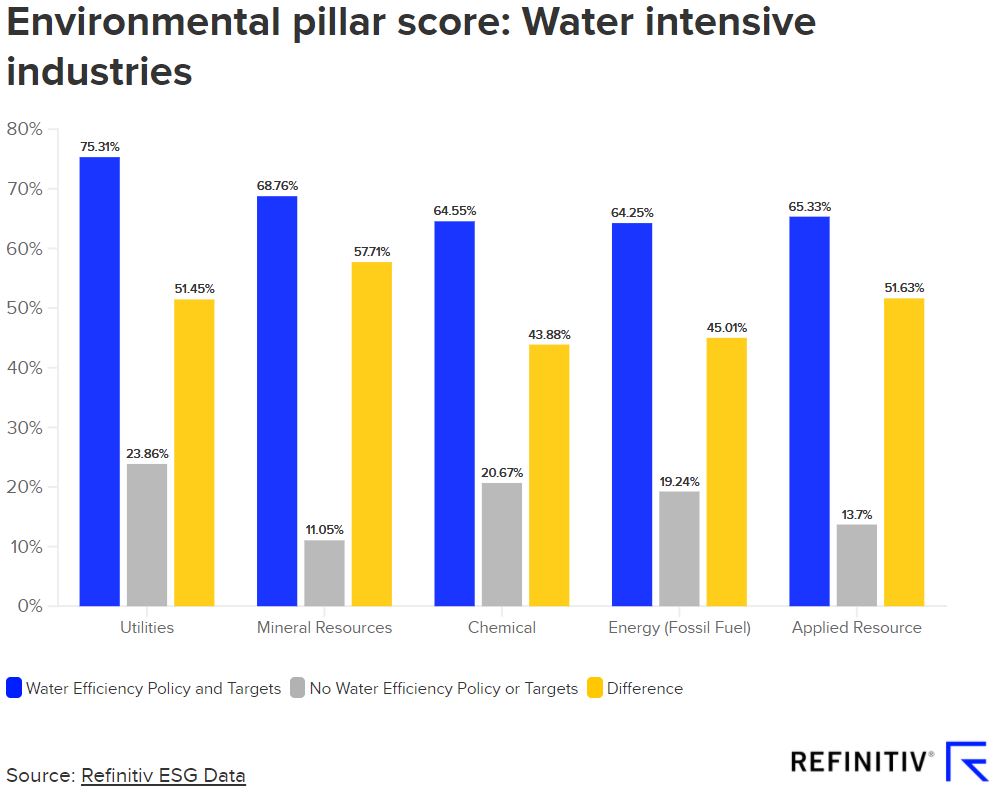

Based on the water withdrawal metric in the database, we see that the Utilities, Mineral Resources, Chemicals, Energy – Fossil Fuel and Applied Resources industries are the most water-intensive.

But we notice reporting/disclosure levels in high water-intensity industries require some work.

Policies and targets by industry

We looked at the most water-intensive companies by industry and compared those with a water policy and targets against companies that report not to have a water policy and targets.

Companies that are putting more emphasis on water usage and practices have a higher Environmental pillar score.

The continued evolution of water metrics

SFDR is pushing EU investors to report environmental metrics within their investments. With increasing pressure to report, we will see increased pressure for corporations to disclose, resulting in a surge of water data becoming available to investors.

Refinitiv is committed to providing accurate, decision-ready, auditable, transparent and comparable sustainability-related data. Our ESG database has solid coverage across the proposed metrics in the SFDR, discover how we can help you disclose against the regulatory requirements.