Lily Dai on analysing green: the challenges of measuring portfolio exposure

Lily Dai, Sustainable Investment Research at FTSE Russell, an LSEG business, shares her thoughts on the Green Economy, the EU Taxonomy and FTSE Russell Green Revenues.

Lily Dai, Sustainable Investment Research at FTSE Russell, an LSEG business, shares her thoughts on the Green Economy, the EU Taxonomy and FTSE Russell Green Revenues.

Q. What are the benefits / challenges in establishing a common classification system to describe the green economy?

There has been a growing focus from the market including investors and regulators on developing the green economy, as we are facing increasing challenges from climate change and other environmental issues such as pollution. To address these issues, we need climate solutions such as renewables, EVs and recycling services that enable the economy to decarbonise.

In fact, USD109-275 trillion of investment in climate solutions is required for achieving net zero by 2050, which means, according to our estimates, approximately 20% of revenue from listed equities globally would be ‘green’ in 2030 and 25% in 2050. Currently the market capitalisation of the green economy is about USD6.5 trillion, approaching 10% of the market. It is still far away from the 1.5°C trajectory, but it also presents a significant investment opportunity.

Having a common classification system on green economy, or a green taxonomy, can help us label and identify these climate solutions and companies providing them. Dataset and financial products developed based on a green taxonomy provides support for both private and public sectors to make investment decisions – seizing investment opportunities, scaling up capital flows and monitoring the performance of green investment.

The challenge is on ‘common’. Ideally, we want a universal taxonomy from regulators across jurisdictions based on climate and environmental science, which applies to the global financial market. The majority of green products and services are similar as climate change and environmental issues are in general global challenges. However, in reality, definitions on green may vary with decarbonisation pathways, geographic locations, natural resources and economic development across countries or regions. For example, there are 47 taxonomies around the world now.

It is important, yet challenging, to ensure interoperability of these taxonomies and remove unnecessary disclosure burdens for corporates and enable investors to measure and compare the environmental performance of investment assets globally. We can’t afford the slowing down of capital flows towards climate solutions due to debates on what is ‘green’.

Q. What are the practical challenges for investors in meeting EU taxonomy requirements?

It is a fairly complex regulation. The delegate acts contain a substantial amount of information on technical screening criteria, which is not easy to navigate. There are significant challenges when applying these criteria in practice: 50% of these criteria face usability issues, as pointed out by the EU Platform on Sustainable Finance. Some criteria are far-fetched, some are ambiguous, and some only refer to the EU legislations that do not apply to companies out of the EU.

Companies may interpret the regulation differently and find it difficult to report against it. For investors, in particular those with global portfolios, it is hard to assess and report portfolio companies systemically given only companies in scope of NFDR (or in future CSRD), mostly European companies, will report the EU Taxonomy alignment, and currently there is a lack of standardised corporate disclosure. We have started collecting reported data and find that out of c.1800 companies we reviewed, more than 50% have not reported EU Taxonomy alignment or have incomplete disclosure without following the reporting template from the regulation.

Q. A growing number of investors are looking to allocate more capital to the green economy – do you think this will ultimately lead to a general improvement in corporate disclosure?

Yes, I hope so, but it will take time. In Europe, we are seeing more disclosure from companies on sustainable economic activities as required by the EU Taxonomy Regulation, although at the moment not all companies in the scope are reporting in accordance with the regulation, as we discussed earlier. In other regions like APAC, the focus is more on green bonds, so the disclosure is more at the bond or project level rather than entity level. Hopefully with more taxonomies being developed in these regions, there will be improved disclosure at corporate level and greater amount of data with higher quality.

In the interim, estimates will play an important role in identifying green business activities. Investors should use datasets that provide the best proxy to measure their exposure to a green economy and make investment decisions. We need to rapidly scale up capital flows into climate solutions and we cannot hold off until there is perfect corporate disclosure.

Q. Does the FTSE Russell Green Revenues Data Model provide a more granular solution for reporting?

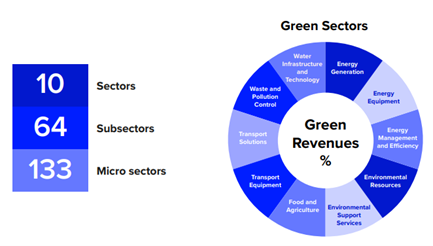

The FTSE Russell Green Revenues data provides detailed analysis on companies’ business activities, identifying those with specific environmental benefits, including climate solutions. The underlying Green Revenues Classification System (GRCS) is highly granular, defining green products and services across the whole value chain covering 10 green sectors, 64 subsectors and 133 micro sectors, based on seven environmental objectives - all six environmental objectives set by the European Commission, plus “sustainable and efficient agriculture.”

To generate the data, companies’ business segments are analysed and mapped against GRCS micro sectors. We screen around 18,000 listed equities across over 50 developed and emerging markets and identify approximately 3,000 companies providing green products and services. For these companies, the dataset provides a detailed breakdown of green activities with data points on green revenues at product or service level as well as at company level. The data history goes back to 2008.

During the assessment process, we also directly engage with companies requesting additional information, if needed. We share our assessment with the company and ask for their verification. When there is no sufficient publicly available information to determine green revenues, we ask the company to provide additional data. If there is no response from the company, we then conduct bottom-up research using proxy data disclosed by the company such as production volume to estimate green revenues.

Q. When measuring exposure to climate risks what other carbon emissions and fossil fuel data is available to investors?

We recently launched LSEG Climate Data package, offering a wide range of metrics to measure exposure to climate risks, including as reported climate data (for example, carbon emissions, energy use and transition plans), CDP data, estimated scope 1, 2 and 3 carbon emissions, Paris alignment indicators (for example, capex commitment to decarbonisation) and carbon reserves (coal, oil and gas production and reserves).

Looking at an index approach, the FTSE TPI Climate Transition index series shows how different climate and sustainable investment datasets can be used in combination. This was built in response to the growing demand for index-based solutions that capture the climate transition and the goals of the Paris Agreement and increasingly sophisticated investment strategies to integrate climate considerations. The index series design incorporates five key climate data inputs from the TPI core assessments and FTSE Russell's climate framework. It over or under-weights companies based on their fossil fuel reserves, carbon emissions, green revenues, carbon performance against the decarbonisation trajectory, and management quality.

Q. Finally, can you tell me about your role as a representative for GTAG?

The Green Technical Advisory Group (GTAG) was established by the HMT to provide recommendations on market, regulatory and scientific considerations on developing a UK green taxonomy. We published a series of advice covering topics such as interoperability, reporting regime, streamlining Do No Significant Harm (DNSH) criteria, application and use cases, data gaps and the use of proxy, etc. The mandate of the GTAG has ended officially over the summer this year following the 2-year term.

In GTAG, I chaired the Usability and Data workstream looking at how to tackle some of the usability issues, in particular how to streamline DNSH criteria and alter the reporting mechanism to improve transparency of corporate disclosure, making it easier for investors to track the sustainability performance of companies under the green taxonomy. The workstream also examined data gaps in implementing the taxonomy and how to deal with the use of estimates or proxy data.

On a personal note, it was a lot of hard work over the last two years, but I really enjoyed and appreciated it. It was great to work together with everyone who is so dedicated to this topic and share knowledge and experience with different perspectives.

Download the Green Economy report to discover more about the growth of the green economy.

© 2023 London Stock Exchange Group plc (the “LSE Group”). All information is provided for information purposes only. Such information and data is provided “as is” without warranty of any kind. No member of the LSE Group make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of FTSE Russell products or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance. No member of the LSE Group provide investment advice and nothing contained in this document or accessible through FTSE Russell products should be taken as constituting financial or investment advice or a financial promotion. Use and distribution of the LSE Group data requires a licence from an LSE Group company and/or their respective licensors.