Sustainable Investment Strategies: The same but different

For the sixth year in a row, FTSE Russell asked global asset owners for their views and practices across a range of sustainable finance issues: 184 participated, represent up to £3trillions in AUM in assets.

For the sixth year in a row, FTSE Russell asked global asset owners for their views and practices across a range of sustainable finance issues: 184 participated, represent up to £3trillions in AUM in assets.

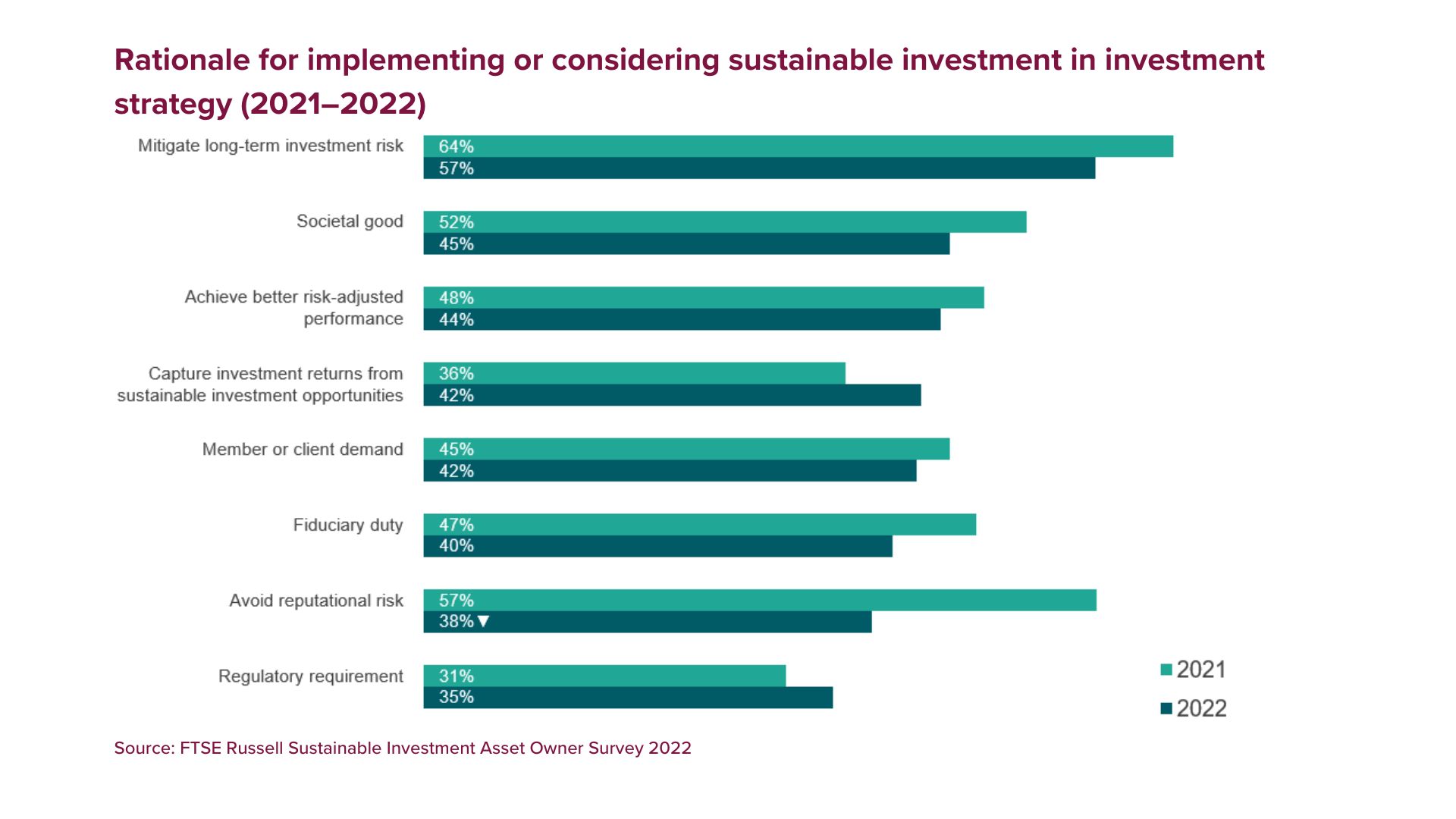

Mitigating long-term investment risk was given as the leading rationale for implementing sustainable investment practices, cited by 57% of survey respondents, a similar proportion to the last time the survey was conducted. Other priorities that were stated were societal good, capturing returns, client demand, fiduciary duty and regulatory requirements.

Investors recognise that environmental, social and governance (ESG) issues have the potential to increase risk and hit returns, and that sustainable investment offers the tools to mitigate those risks.

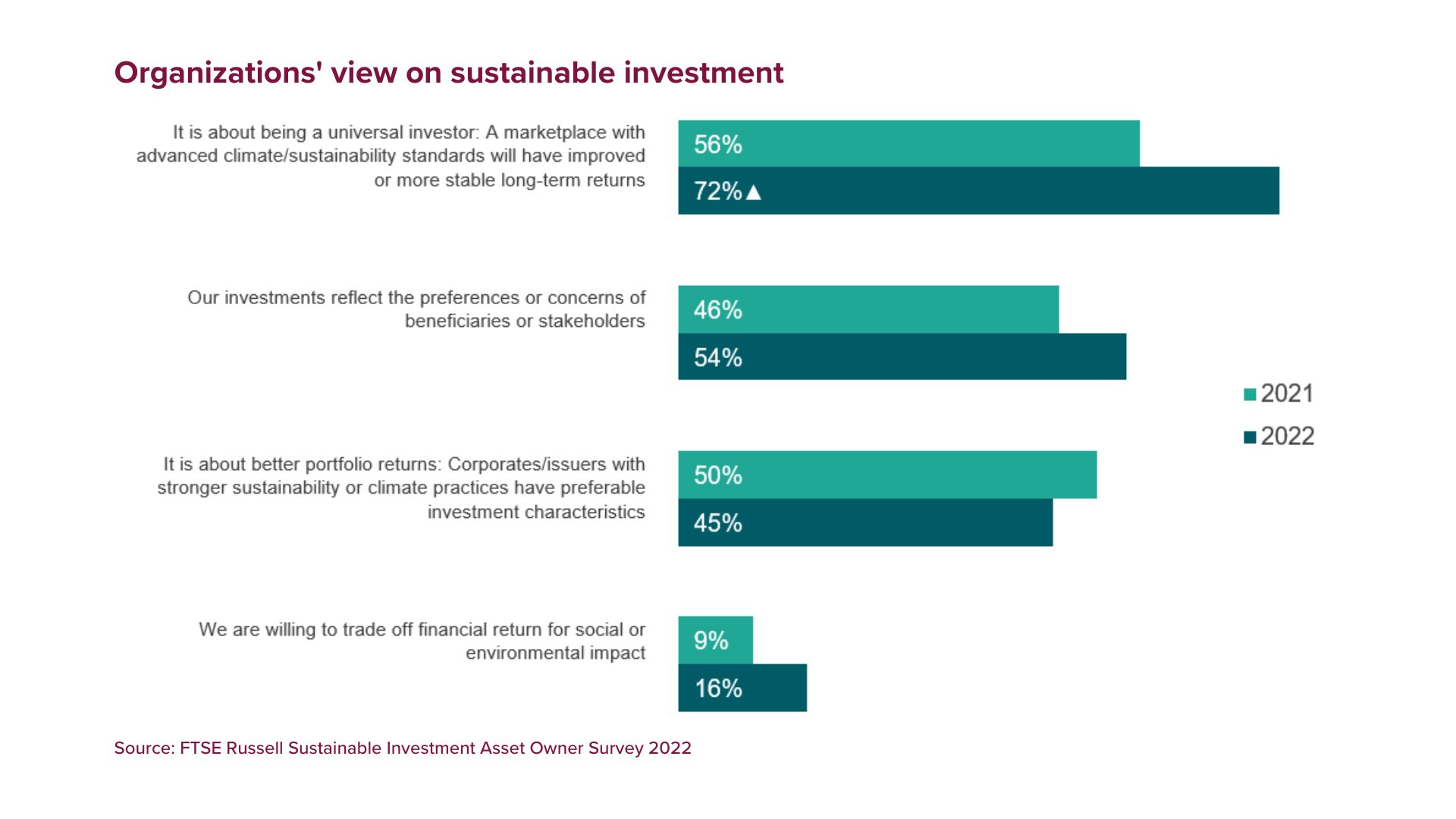

In addition, investors understand that it is often not possible to simply trade around these risks. Almost three-quarters (72%) of respondents consider sustainable investment to be about being “a universal investor”, one who is invested across the entire economy. They agreed with the statement that “a marketplace with advanced climate/sustainability standards will have improved or more stable long-term returns.”

Climate change and the associated low-carbon transition is perhaps the clearest example of a long-term risk that asset owners identified early and have taken action to mitigate. They have proved instrumental in encouraging regulators to require better corporate disclosure. They have pushed investment consultants and managers to provide products and services that aim to address climate risk. They have also encouraged policy makers to take action, advocating for net-zero targets and the policies and measures to deliver them.

For some investors, this has proved an occasionally uncomfortable process. Solving a long-term, society-wide issue such as climate change is, ultimately, a job for policy makers. In those countries were taking action to reduce emissions is politically divisive, investors advocating for climate action are necessarily taking a side.

The same is true for many ESG issues that pose long-term risk to investors. Ethnic and sexual discrimination, poor labour rights, overexploitation of nature or aggressive tax policies are all society-wide issues that can be politically controversial. Investors who perceive risk from these issues, and who seek to address those risks at least partly through the policy process, can find themselves in the political firing line.

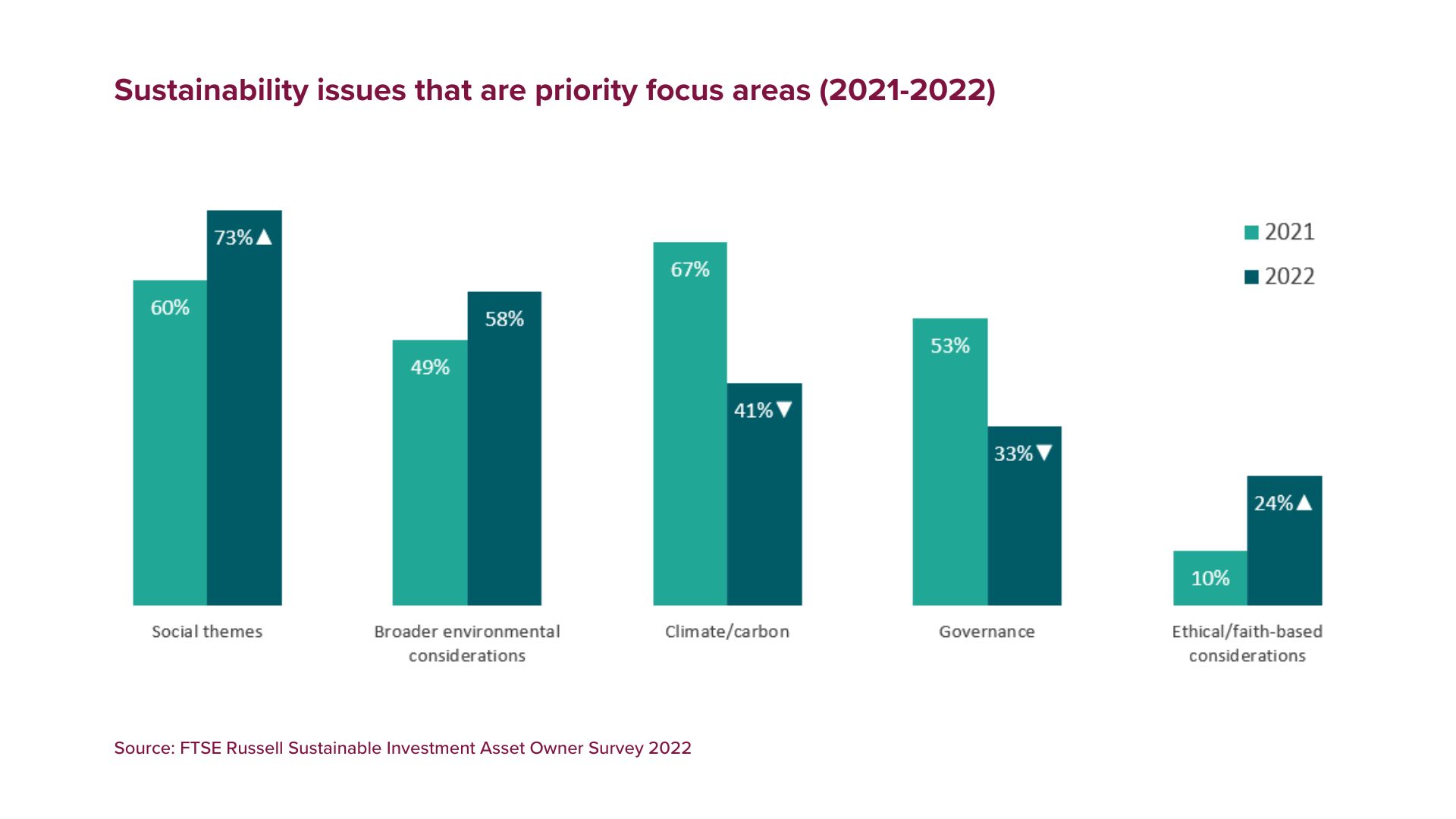

Framing investor preferences on ESG policy positions more clearly in terms of risk management will be important in the years to come. The survey found that social themes are rising up the agenda. Nearly three-quarters (73%) identified social themes as a priority focus area, replacing climate change, which dropped into third place behind broader environmental considerations and governance. This suggests that the voice of asset owners could become louder in public policy debates; understanding their motivations will be critical.

For more information, please see our Sustainable Investment: 2022 global survey findings from asset owners.