Seeking coordinates: A unique engagement on physical climate risk

A report on Impax Asset Managements engagement with companies about the physical risks posed by climate change.

Flooding, droughts, rising sea levels and extreme weather events are posing increased risks not only for companies but for investors, financial markets and the global economy. Two-thirds of large companies around the world have at least one asset at high risk because of the physical hazards created by a warming climate.1 It is essential that financial markets plan for the physical risks of climate change.

Where a company operates is a major factor in its exposure to physical risks. While companies often provide general geographic information about the locations of their assets, such as states, regions or countries, that is not specific enough. Investors need much more precise physical location data from companies to help make sound long-term financial decisions.

In late 2020, Impax teamed up with the New York State Common Retirement Fund to ask listed US companies in the S&P 500 Index to voluntarily disclose the locations of their significant assets, including facilities, buildings and installations whose loss or impairment would impact financial results.2

We received responses from 13% of the companies. Only three demonstrated to us that they had seriously considered their liabilities due to physical climate risk and had plans for adapting to or mitigating those risks.

What we asked S&P 500 companies:

Where are the facilities whose loss or damage might be a material event?

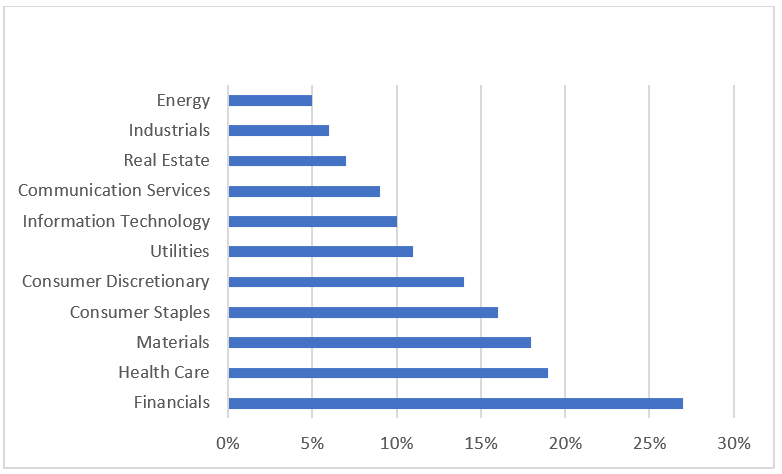

Response Rate of the S&P 500 to Physical Risk Letter, by Sector

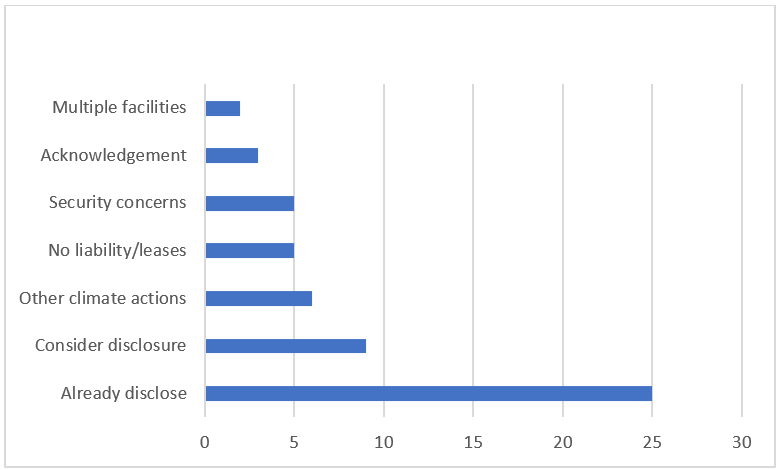

Number of S&P 500 Respondents, by Type of Response

While it was encouraging to learn that at least a few companies have given physical risk much thought, these responses illustrate how unprepared most companies are for the effects of climate change. We believe that our engagements will help put this topic on the agenda for boards and executives.

In our report ”Physical Climate Risk and the S&P 500,” we explain our engagement and detail the responses by sector, how executive suites are thinking about physical climate risk, and what we’ve concluded about companies’ preparedness for the physical risks of climate change.

Go to the full report here.

The authors would like to acknowledge Eri Yamaguchi, ESG Investment Officer at New York State Common Retirement Fund, whose insights have been essential to this engagement.

1S&P Global, “Physical Risks,” http://www.spglobal.com/esg/education/essential-sustainability/climate/physical-risks?gclid=CjwKCAjwr56IBhAvEiwA1fuqGiu-wj6EseQ3n-k4VGkGyNA2oyLUmhEROMk3eZJge1jyD1gCKrtnXBoCs8cQAvD_BwE. Accessed Sept. 15, 2021.

2Impax does not own shares in all the companies in the S&P 500 Index.

The S&P 500 Index is an unmanaged index of large capitalization common stocks.