Negative SDG contribution data now available from SDI AOP platform

The Sustainable Development Investments Asset Owner Platform (SDI AOP) has been expanded to include information on companies’ products and services that are inconsistent with achieving the UN SDGs.

The Sustainable Development Investments Asset Owner Platform (SDI AOP), which helps investors imbed the UN’s Sustainable Development Goals (SDGs) into investment processes, has been expanded to include analysis of companies’ negative contributions to the goals. The upgrade was released as part of the platform’s latest data update in August 2022 and was accompanied by rule refinements and additional functionality for subscribers.

The SDI AOP provides a groundbreaking tool to assess businesses’ revenue streams based on their contribution to the SDGs, and until now focused exclusively on positive impact. Introduced in 2020 by a consortium of asset owners APG, AustralianSuper, British Columbia Investment Management Corporation and PGGM, the SDI AOP is committed to accelerating the market adoption of Sustainable Development Investments (SDIs). Qontigo is the SDI AOP’s exclusive distribution partner.

James Leaton, Research Director at the SDI AOP, explained: “The original focus of the SDI AOP was on the opportunities related to SDGs based on positive contributions towards the goals. Following engagement with users, we have added data on products and services that are inconsistent with achieving the SDGs. This mirrors what we do on the positive side and gives greater differentiation across the universe of companies.”

The approach taken to determining negative SDG contributions follows the same methodology as the existing positive contributions. The SDI classification focuses on companies’ product and service-related contributions to the SDGs based predominantly on revenues. The SDI AOP does not net the positive and negative contributions, as “this would bury the complexity of considering impacts across different SDGs and diminish transparency around companies’ real-world impacts,” said Leaton.

A snapshot of global companies’ impact

The platform’s data show that across a universe of nearly 9,000 entities, just under 600 have a material level (>10%) of negative products or services. Around 150 further companies have less than 10% of revenues generated by negative activities. By comparison, over 2,000 entities have been identified to have over 10% of revenues from SDG-aligned products and services.

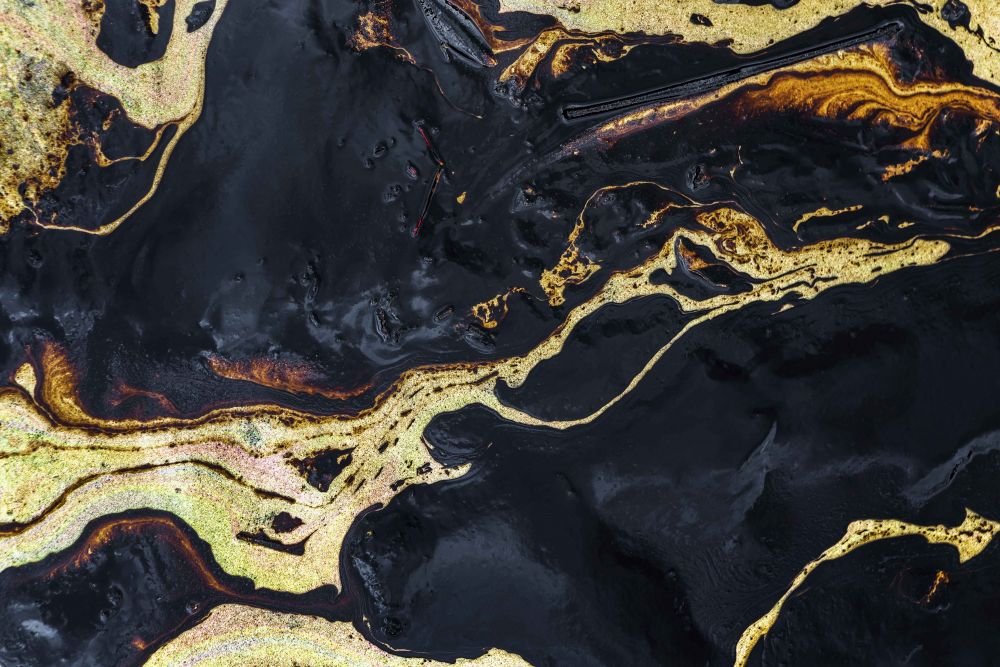

Within negative classifications, the most prevalent exposure is under SDG-7 (Affordable and Clean Energy), in relation to fossil-fuel products …