How can slowing climate change accelerate your financial performance?

The EY 2022 Sustainable Value Study finds that companies acting on climate change are surpassing expectations financially but are not progressing at the speed or scale required to meet the goals of the Paris Agreement.

Climate change is everybody’s business. While government delegates meet at COP27 to deliberate on how to slow climate change, the private sector has a role to play, too. Companies have almost universally accepted this fact. Our survey of more than 500 companies leading on sustainability finds that 93% have made public climate commitments. In spite of that, progress remains too slow to deliver the emissions curbs the world needs.

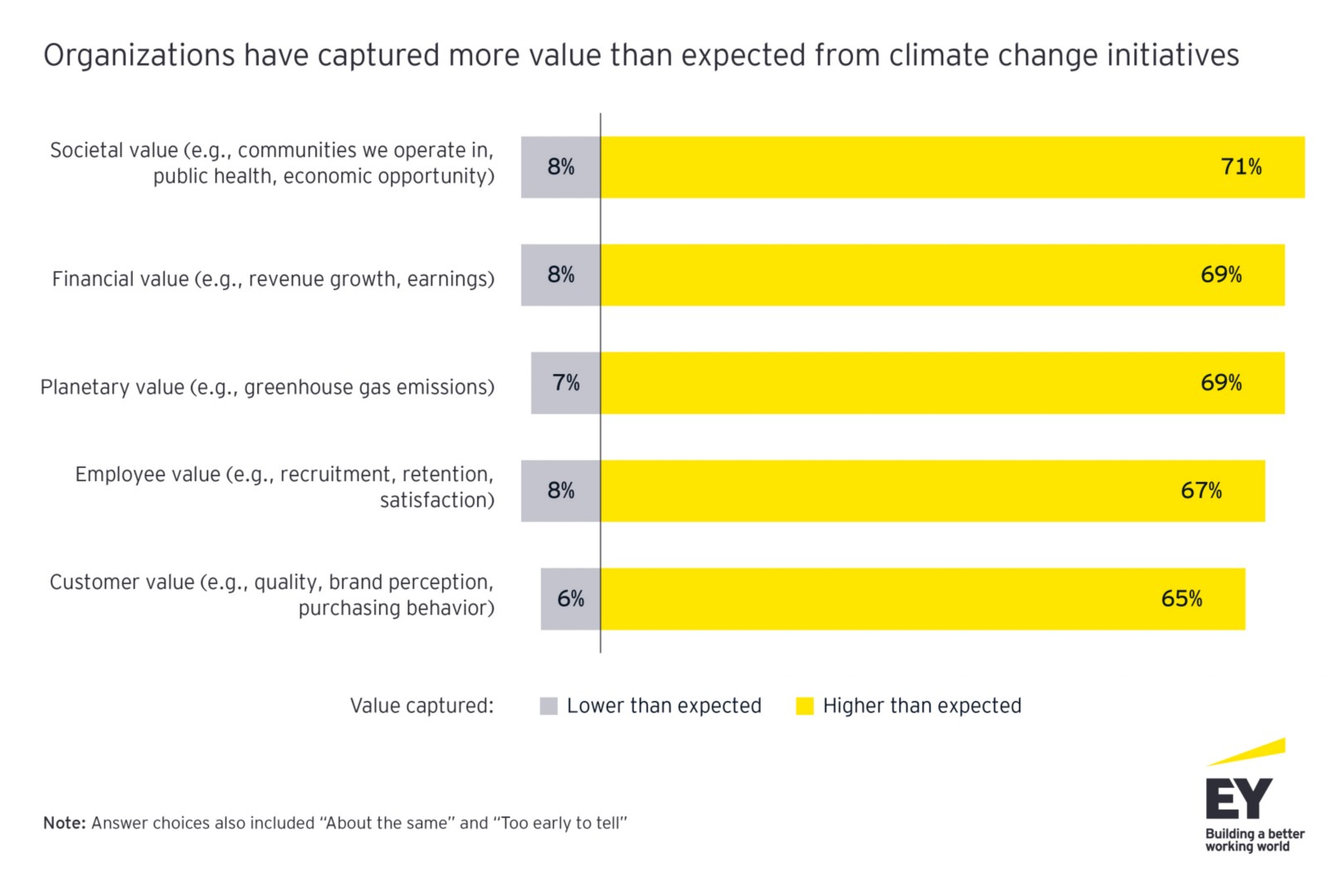

Yet companies that take decisive climate action do not just create more value for the planet, they also capture more financial value for themselves on measures such as revenue growth and earnings. At the global EY organization, we call this value-led sustainability. More than two-thirds of all respondents — 69% — report that they capture higher financial value than expected from their climate initiatives. This challenges the perception that there is a trade-off between financial and nonfinancial impact.

Companies are reducing emissions, but not at the speed or scale needed

The positive news is that companies are committed to climate action. As indicated, the vast majority of companies in our survey have made public commitments.

There is room for improvement on the scale and speed of these reductions, however. The United Nations Intergovernmental Panel on Climate Change calls for the world to cut emissions by 45% by 2030 and achieve net-zero emissions by 2050 to keep global warming below 1.5 degrees Celsius above preindustrial levels. Yet in our survey group of leading companies, only about four in 10 plan to reduce emissions by 45% or more (excluding carbon offsets), and just 35% of companies have a commitment milestone on or before 2030.

A value-led sustainability approach is driving financial impacts

Companies that undertake climate change initiatives tend to find that they return significantly more financial value than expected. One reason for this is that they return other forms of value, such as customer and employee value, which in turn contribute to financial goals.

Today, companies are almost twice as likely to prioritize financial value than planetary value as the most important consideration when evaluating a climate investment (28% vs. 15%). Some companies have started making the connection between their investment in climate initiatives and delivering long-term value to the business.

Because they are often selected with financial value in mind, climate initiatives are more likely to have a positive than negative financial return. What’s unexpected was the size of the return. Nearly seven in 10 companies report capturing somewhat or significantly higher-than-expected financial value from their climate initiatives.

Of course, companies can’t realistically expect every initiative to have a positive financial impact. The key is creating a balanced portfolio — initiatives that generate financial value subsidize those that have positive planetary impact but minimal or negative financial return. We see that, on average, 37% of initiatives will have a positive return over their lifetime, while only 19% will have a negative return. This should motivate those in the early stages of their climate action journey to increase their investments in climate initiatives.

The more companies act on climate change, the better their returns

For all companies, climate action is a journey, and the most appropriate climate actions for any given company depend on where it is.

Our survey mapped out 32 climate actions, ranging from incremental to strategic and transformational. On average, companies have completed 10 of the 32 actions, signifying most companies are at some stage of turning their commitments into action.

These actions fell into five broad categories: measurement, governance, operations, customer and supplier, and third party. Actions that focus on measurement and governance are common starting points, with initiatives in these areas representing the top-five most-completed actions overall. At the initial stages of their journey, companies typically focus on actions that require less financial outlay, such as identifying major emissions sources or assigning board responsibility for climate.

Pacesetters — companies that are relatively mature in terms of their climate action journey — are taking action across all five categories. One clear result is that such a broad-based, value-driven approach pays off. Pacesetter companies are 2.4 times more likely to report significantly higher financial value than expected (52% vs. 21% of observer companies) and have achieved a larger reduction in emissions to date (32% vs. 27%).

Five actions to advance your climate journey

Our research identifies a number of actions that companies should take in order to create more value from their climate agenda for their stakeholders and for the planet.

- Challenge your level of ambition – Even for the companies included in this survey that have demonstrated commitment to change, we are not seeing ambitious-enough targets to meet the goals set forth in the Paris Agreement.

- Recognize complexity – Driving true impact on emissions reduction is a complex process and requires measurements to track progress and assess ROI from the onset.

- Collaborate – Collaborate both within your sector and across sectors. This is a collective challenge and working with industry and cross-sector groups will accelerate change.

- Influence your supply chain – Many organizations will have the greatest opportunity to influence emissions reduction through their supply chains by engaging and supporting suppliers.

- Invest in talent – Too many companies recognize there is insufficient sustainability talent available to meet the challenge but are not making this a priority. Upskilling across all relevant functions in the organization and attracting specialists can become a source of advantage.

We’re not there yet

The imperative to act on climate change is urgent. The coming years offer a narrow window during which it is still possible to limit Earth’s temperature rise to 1.5 degrees Celsius.

Companies have a key role to play in this, but they need to think differently about this challenge. They should no longer assume there is a trade-off between financial value and climate initiatives. Rather, they should see climate initiatives as a means of protecting and creating more value for business, society and the planet simultaneously.

Read the full article to learn more.