Global asset owner sustainability survey sheds light on regional differences

Since we first surveyed global asset owners in 2017, we’ve learned more with each passing year about their awareness, attitudes, and behaviors when it comes to Sustainable Investment (SI).

_960_540_80.jpg)

Since we first surveyed global asset owners in 2017, we’ve learned more with each passing year about their awareness, attitudes, and behaviors when it comes to Sustainable Investment (SI). This annual survey is valuable barometer for shifting attitudes amongst asset owners globally, and this year we had almost 200 asset owners taking part, giving us good representation across Europe, North America and Asia-Pacific.

The results of this year’s fifth annual survey are no surprise—they demonstrate the rapidly rising trajectory for SI implementation among asset owners to the point where it is has now become the norm globally. But perhaps more surprising, the survey responses also shed light on significant regional differences in how asset owners approach and think about sustainable investing including very different views on sustainable finance regulation.

Implementation rationale: Better performance or societal good?

Asset owners can look to implement sustainable investments for a number of reasons. For some investors, integrating sustainable considerations is about contributing to societal good and may be linked to an investment philosophy around being a “universal investor” with a stake right across the global economy. But for others it can be about a more direct focus on returns and performance, particularly as a growing number sharing an investment believe that sustainable investment correlates with better returns—and that sustainability risks like climate change are significant sources of investment risk.

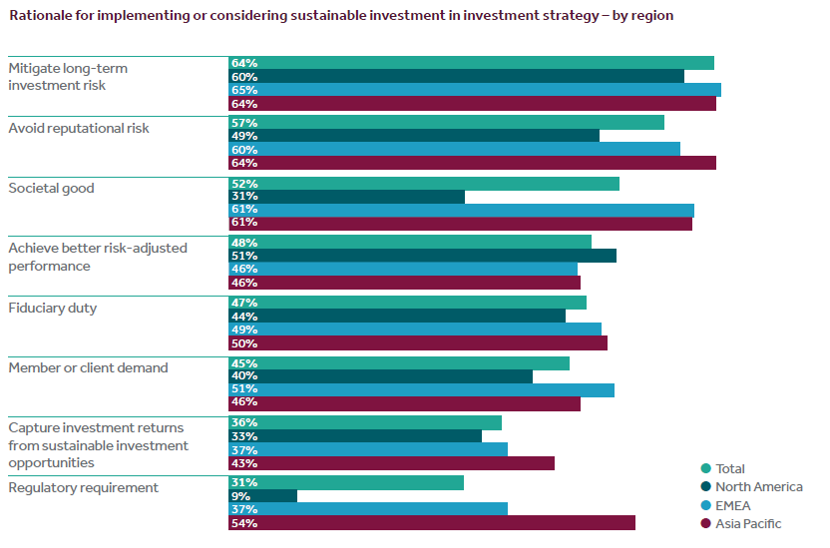

Our 2021 Global Asset Owner Survey found that these reasons vary considerably by region. For North America, the top two reasons—mitigating long-term investment risk and achieving better risk-adjusted performance—are related to investment returns. However, only 31% of North American respondents cited societal good as a motivation for implementing SI considerations, while this was a top reason for the EMEA and APAC regions.

Sustainable priorities: Climate or social issues?

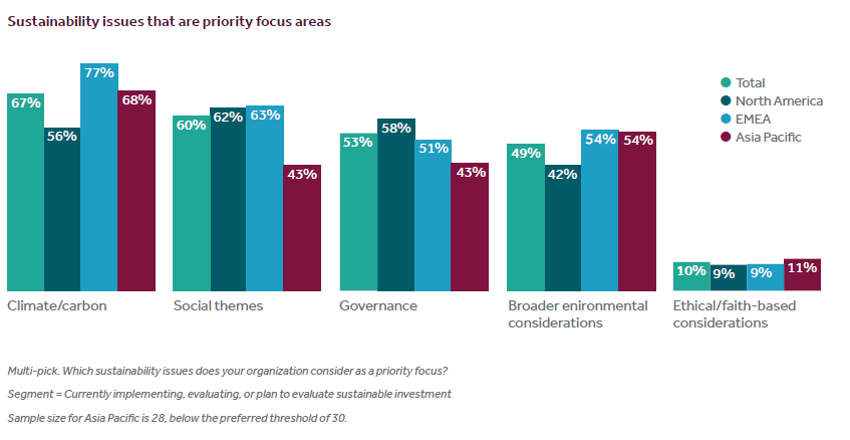

Global regions also differ with respect to how they prioritize sustainability issues. As shown, North American asset owners cited social themes as their top priority focus, while other regions prioritize climate/carbon by a considerable margin.

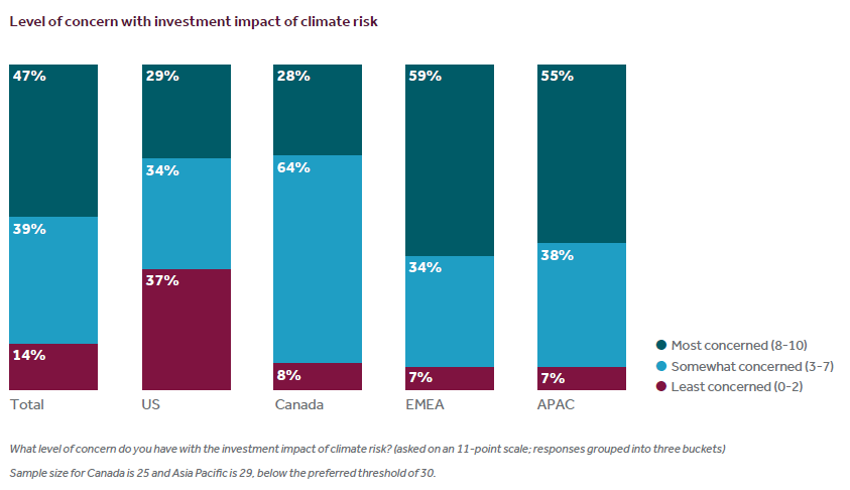

Given this disparity in sustainability issue priorities, it should perhaps come as no surprise that North American asset owners also differ from other regions when it comes to their attitudes toward climate risk. More than half of those surveyed in EMEA and APAC are most concerned about the investment impact of climate risk, compared with less than 30% for the US and Canada.

One likely reason behind these varying attitudes toward climate risk is how politicized climate change has become in the US relative to other countries. And this has coincided with the global pandemic casting a spotlight on social issues such as socioeconomic and racial inequality—particularly in the US.

To regulate or not to regulate?

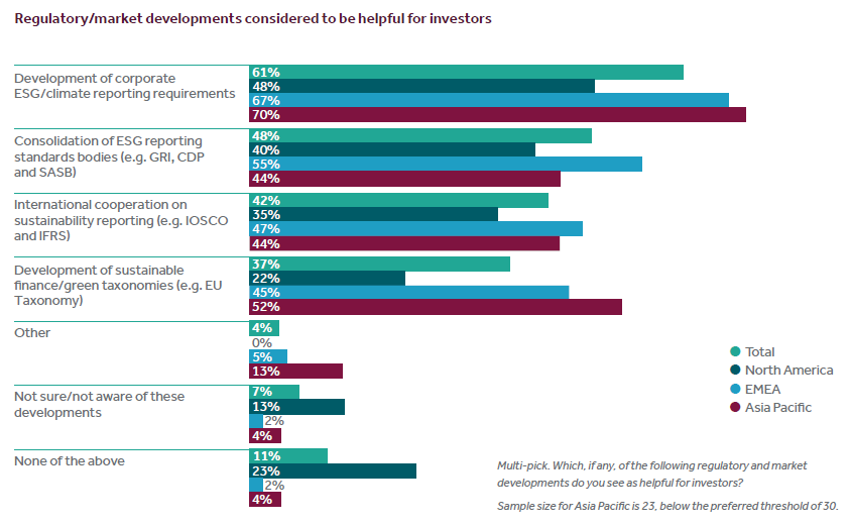

For those asset owners who didn’t prioritize social issues, many cited a lack of reliable and widely available social data as a key reason. Recognizing the growing importance of sustainable investment regulation and data standardization, we surveyed asset owners on the topic for the first time in our 2021 survey—and found more instances of regional disparity.

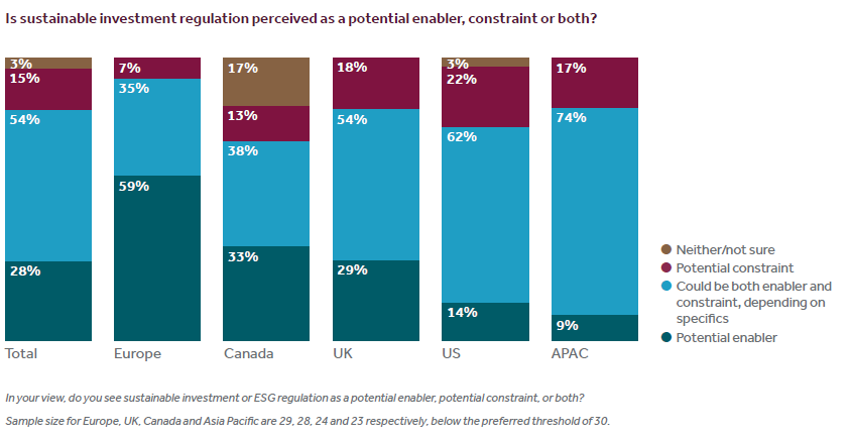

Notably, responses differed with respect to whether asset owners view regulation of sustainable investment as a potential enabler or constraint. In Europe—where sustainable strategies have been most widely implemented—the majority of asset owners see regulation as an enabling factor, while those in other regions have more mixed views.

Exactly how regulation could help enable sustainable investing is another important question. Among those asset owners who don’t see regulation of sustainable investment as a constraint, a resounding 78% believe that regulations might improve the quality and consistency of corporate reporting and disclosures.

Trendspotting and adapting

As the sustainable investing landscape has seen rapid growth over the past five years, it has also evolved considerably. Regional disparities have emerged as a recent trend in our 2021 survey, but it remains to be seen whether these responses will continue to diverge—or if new trends will take shape as the sustainable investing market matures. Each year, we’ll continue to adapt our Global Asset Owner Survey to accommodate emerging trends and areas of interest for our clients and the global asset owner community.

For more information, see Sustainable Investment: 2021 global survey findings from asset owners.

© 2021 London Stock Exchange Group plc (the “LSE Group”). All information is provided for information purposes only. Such information and data is provided “as is” without warranty of any kind. No member of the LSE Group make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of FTSE Russell products or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance. No member of the LSE Group provide investment advice and nothing contained in this document or accessible through FTSE Russell products should be taken as constituting financial or investment advice or a financial promotion. Use and distribution of the LSE Group data requires a licence from an LSE Group company and/or their respective licensors.