Unlocking private capital for low carbon projects: the next steps

The latest Climate Action webinar, held ahead of the Innovate4Climate event discussed the latest progress on scaling low carbon projects

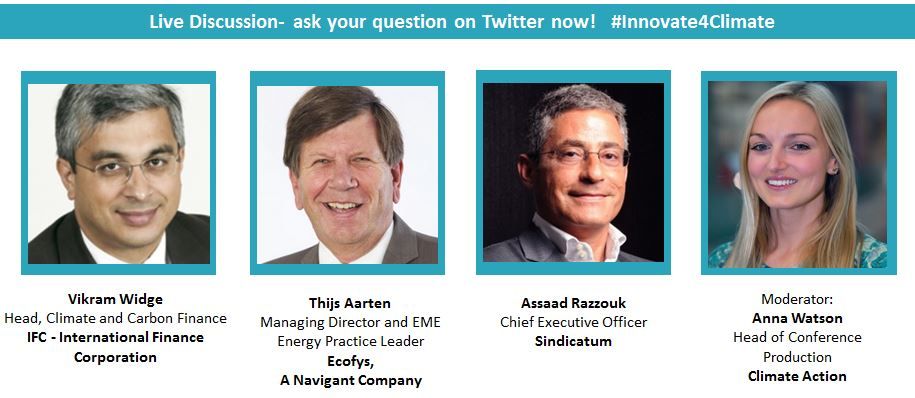

The latest Climate Action webinar, held ahead of the Innovate4Climate event, united Vikram Widge, Head of Climate Finance and Policy at the IFC, Thijs Aarten, Managing Director and EME Energy Practice Leader of Ecofys, A Navigant Company and Assaad Razzouk, Chief Executive Officer of Sindicatum to discuss the latest progress on scaling low carbon projects.

A holistic view

Unlocking private capital is central to filling the $670 billion gap in annual finance flows needed for a transition to a low carbon economy. Thijs Aarten evoked the three main conditions to encourage private sector investment: an enabling environment, resources and a pipeline of projects. Vikram Widge added that markets need to be nurtured with technical assistance, low-cost patient capital and the catalyst of external finance. Vikram identified that ‘good policies create strong markets’ and that the IFC’s focus is ‘moving upstream’ beyond an opportunistic view of individual projects to view things more holistically.

Katja Eisbrenner of Ecofys joined Thijs to insist on communication with and involvement of all relevant stakeholders, including governments, industry players and investors. According to Katja, the policy language and the banking language are often different, and she called for technical and financial proposals to be developed at the same time.

Improved policies and regulations

The Task Force for Climate-Related Financial Disclosure will be presenting their recommendations to the G20 Finance Ministers in July, to encourage the adoption of global standards for the private sector. Vikram pointed out the need for private stakeholders to understand and identify the impact of their own investments before they disclose and report on their investments. As financial risk is integrated in the design of investment portfolios, the physical risk associated with climate change also needs to be taken into account by investors, which they usually do not according to Assaad Razzouk, as there is ‘no price on environmental destruction’.

Vikram and Thijs both agreed that good policies create an enabling environment for strong markets. Thijs emphasised the need for clear directions from governments through legal and regulatory frameworks such as carbon pricing and renewables subsidies. He discussed how the smart use of public money can leverage private capital to reduce risk. Thijs also highlighted the importance of transparency and disclosures of climate risks to help the recognition of the value of low carbon investment, and to help translate climate risk into financial language. Vikram insisted on integrity being key to developing legal and regulatory frameworks that are adapted to each country’s needs and national goals, thanks to different and adjusted policies.

Emerging Market Opportunities

Low carbon investment represents a real financial opportunity for investors. Vikram gave an example from one of the IFC’s recent report on emerging markets, which identified a $23 trillion investment opportunity. The report examines 20 emerging countries, with the most attractive sectors being green building in East Asia, climate resilient infrastructure in South Asia, low carbon transport in Latin America and renewables and energy access in Africa and the Middle East.

Katja said projects need to be developed bottom up, and we need to identify the investment opportunities that are in line with SDGs and economic development at the same time. Katja added that we need to learn from the lessons of the past before creating new concepts and terminologies that have less meaning because they are not based on practical experience. For example, Ecofys helps the European Investment Bank to analyse previous investments in mitigation in the MENA region to identify those projects that can be scaled up.

Sponsored Content

Opening equity markets

Another opportunity lies in the equity market, which is missing from the climate finance market, according to Assaad. He suggested that multilateral and development banks should focus on opening stock markets to institutional capital markets and climate-friendly issuers, and to back more Initial Public Offerings (IPOs). According to Assaad, equity represents the real opportunity, being more profitable than debt and bonds. Vikram added that the IFC was already active in this sector with $8 billion of equity currently under management and different funds designed to help people investing in sustainable solutions, including renewable energy. Vikram insisted on the importance of both equity and debt. For example, green bonds are very effective financial tools that help the industry pursue national and international goals. Concessional finance and the Green Finance Fund also help to unlock private capital markets.

New financial mechanisms

In order to facilitate financial flows, innovative financial tools are necessary. Our panellists talked about the some of the most well-known climate finance instruments: green bonds and carbon pricing.

The IFC and the World Bank Group were pioneers in the issuance of green bonds. The IFC has issued around $5.8 billion of green bonds so far, in twelve different currencies. Vikram mentioned that the organisation is to announce a new cornerstone fund that will help financial institutions in emerging markets set up the initial structure to issue green bonds, with the overarching goal of ultimately making green bonds a mainstream asset class.

Vikram then evoked the example of the IFC Forest Bond as an innovative financial product, which gives investors the option of getting repaid in either forestry (carbon) credit or cash. The $152 million 5-year bond was listed on the London Stock Exchange and it was quickly oversubscribed. Vikram pointed out that the forestry sector will need $75-300 billion investment in the next decade.

Carbon pricing is also a great tool that has helped to reduce GHG emissions where applied. Thijs emphasised the importance of engaging both the policy makers and the private sector when setting carbon pricing, but agreed with Vikram that carbon pricing –although crucial and efficient – is to be considered as a tool amongst others.

Moving forward

All panellists agreed that communication between the different stakeholders was central to unlocking private capital and developing new financial products, both in debt and equity, to catalyse financial flows.

The World Bank Group’s Innovate4Climate week in Barcelona on 22-25 May 2017 is a premium platform, gathering policy makers, industry professionals and financiers to discuss these issues further. Book your place today to meet our webinar panellists and over 1000 other delegates at the week of events and join 60+ influential speakers at the Unlocking the Trillions Summit.

To listen to the full webinar, visit this page