World Bank announces €1.5 billion Sustainable Development Bond

Major advancement in the green economy in support of the Sustainable Development Goals has been met this week.

Major advancement in the green economy in support of the Sustainable Development Goals has been met this week.

The World Bank has announced a 10-year Global Sustainable Development bond on May 16. The investment goal of €1.5 billion was significantly oversubscribed, reaching €2 billion from 69 investors.

Barclays, J.P. Morgan, Natixis and TD Securities will be lead managers in the transaction, which is the World Bank’s first 10-year euro global bond in 10 years, and the first euro global bond since 2018.

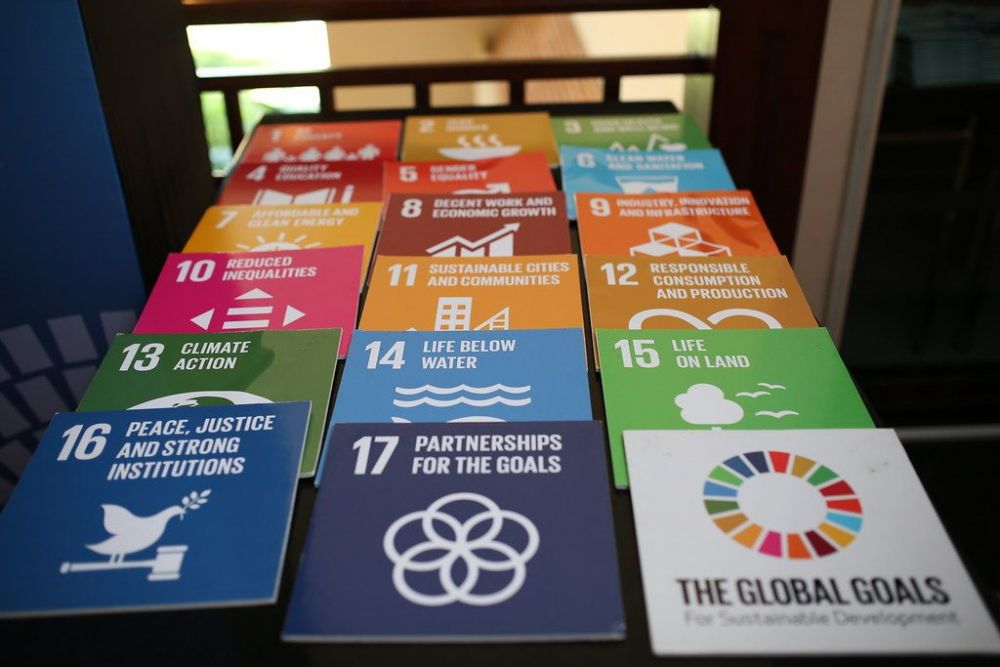

The bond’s finance will fund projects advancing the Sustainable Development Goals (SDGs) agreed by the UN in 2015 on climate action, gender equality, humanitarian aid, and strengthening international governance.

The investment coincides with the ‘Catalyzing Global Savings to Advance Our Sustainability Goals’ workshop held in Dublin, convening bond investors, issuers and market participants to assemble action for the SDGs. The bond has been announced in the first of a series of workshops that aim to assemble action for the Sustainable Development Goals.

Paschal Donohoe TD, the Irish Minister for Finance & Public Expenditure and Reform has supported the bond in its alignment with Ireland’s ‘A Better World’ policy. “We welcome the World Bank’s new sustainable development bond to raise awareness for SDGs that are aligned with our priority areas of prioritizing gender equality, reducing humanitarian need, climate action, and strengthening governance.”

The bond signifies the increasing investment of companies to adopt frameworks in support of the Sustainable Development Goals. Trucost’s 2018 report revealed in 2017, SDG-aligned businesses generated $233 billion in revenues, underlining significant economic opportunities for both SDG and sustainable policy frameworks.

The efforts of the financial community to achieve SDGs is maintained under this bond, and contributes to the growing 9000 companies and investors that have pledged to support the SDGs since 2015.

Read the full report here.

Photograph: World Bank

Interested in learning more about sustainable finance? Join us in New York for the Sustainable Investment Forum North America on the 25th September 2019 for the latest insights from asset owners and managers, banks, development institutions, policymakers, think tanks and NGOs looking to drive the sustainability agenda.