Giant Spanish bank announces €100 billion plan to fight climate change

BBVA, the second largest bank in Spain, has launched a major new financing initiative to support sustainable development and combat climate change in the coming years.

BBVA, the second largest bank in Spain, has launched a major new financing initiative to support sustainable development and combat climate change in the coming years.

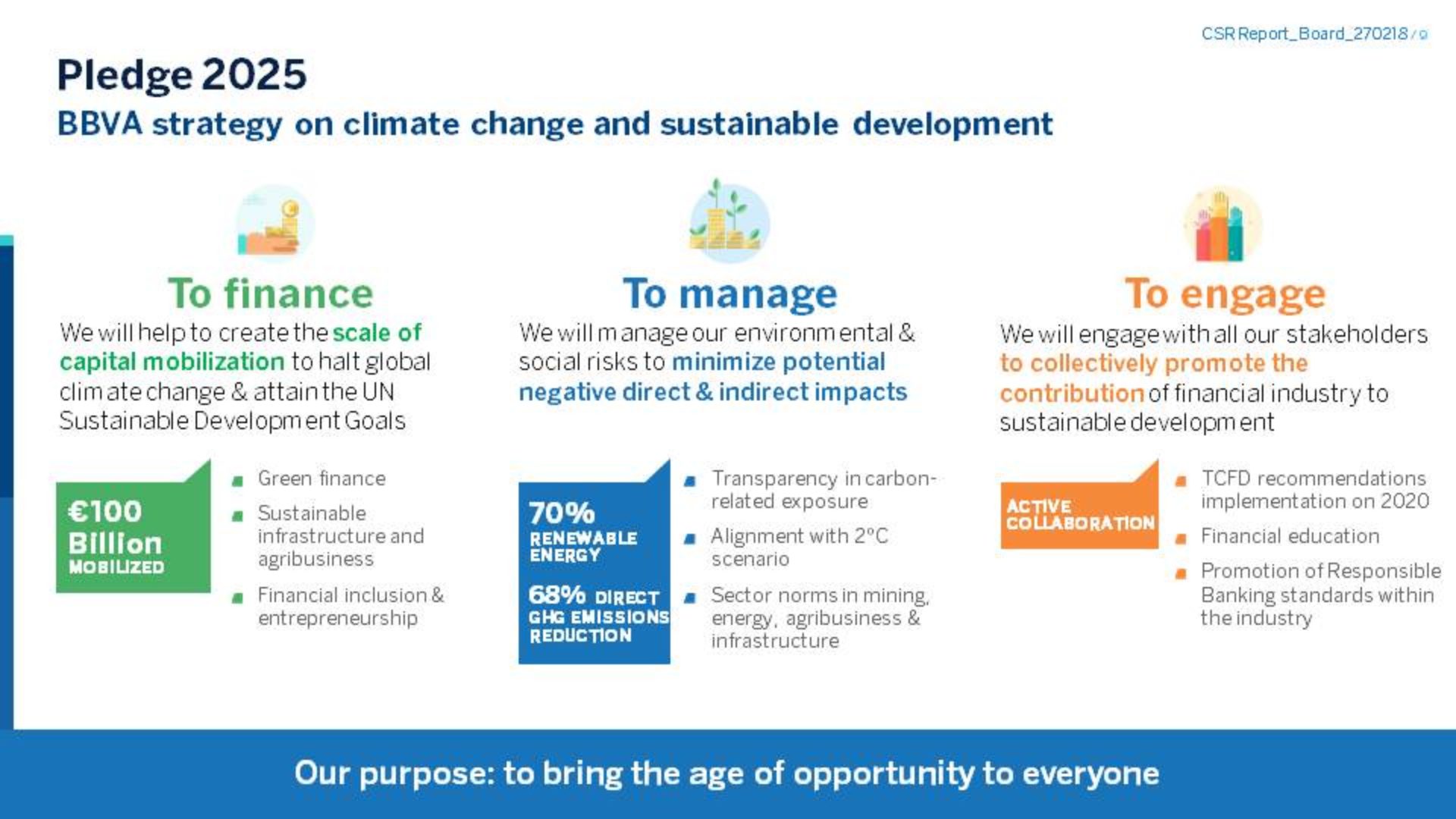

The group’s new strategy, called Pledge 2025, is a significant step forward in the large-scale financing needed to meet the goals of the Paris climate agreement.

The pledge contains a suite of new policies, including a target of investing €100 billion in supporting “green finance, sustainable infrastructures, social entrepreneurship and financial inclusion” over the next eight years.

BBVA will also work to manage its own environmental risks and energy usage, targeting 70 percent of its energy consumption to come from renewable sources and cut carbon dioxide emissions by 68 percent, using 2015 as a baseline.

BBVA Group Executive Chairman Francisco González said, “At BBVA, we want to play a key role in mobilizing resources to halt climate change and promote sustainable development. It is an ambitious, long-term goal in line with our purpose of ‘bringing the age of opportunity to everyone.’”

The bank is also planning to scale-up its work within the industry to promote sustainable finance and increase transparency. It has revealed its current exposure to fossil fuels at 3.4 percent of total assets.

At its heart, the strategy is designed to align with the goal of reducing global temperatures to well below 2 degrees by 2050, and help meet the UN’s Sustainable Development Goals (SDGs). As part of this, any new sustainable bonds it issues will be linked to the SDGs.

BBVA has also become the first Spanish bank to commit to the Science Based Targets Initiative. The campaign helps major corporates work out how they have to cut emissions to prevent the impacts of climate change.

In developing this ambitious new strategy, the bank has worked with a range of groups to help shape its contents, including the non-profit ShareAction, which promotes responsible investment.

Sonia Hierzig, banking project manager at the charity welcomed the new commitments, stating “we are very pleased that many of our recommendations have been adopted”

“The bank’s new policies would mean that BBVA would now rank 7th in our climate ranking of the 15 largest European banks…This is a huge step forward in a very short space of time, and will hopefully set an example and illustrate to other banks what is achievable”, she added.

Photo Credit: BBVA