Turning sustainability talk into action

It’s hard to convey the intensity of our current sustainable investment (SI) interactions with clients and stakeholders.

It’s hard to convey the intensity of our current sustainable investment (SI) interactions with clients and stakeholders.

SI is everywhere: it has become the new normal. Even for indices and products that are non-SI by design, sustainability comes up month after month, quarter after quarter in almost every client discussion.

But talk, as they say, is cheap. To turn SI talk into action, we need the right conceptual framework, adaptive index designs, ample resources, data that are fit for purpose and forward-looking management.

Let’s take the recently introduced Paris-Aligned Benchmarks (PAB) and Climate Transition Benchmarks (CTB) as an example of the first two points.

PAB and CTB, in my view are the most sophisticated sustainable mass-market climate indices you can find today. They reflect very clear thinking on the part of European policymakers.

PAB are designed to mitigate climate transition risks, capture investment opportunities in the green economy, and allocate equity portfolios in a way that supports the decarbonisation of the economy. They aim for a consistent, 7 percent reduction in greenhouse gas emissions per year, with a 50 percent target reduction over a decade.

CTB set a slightly less ambitious decarbonisation trajectory, with a 30 percent emissions reduction goal in ten years.

But this type of index places new demands on the index provider.

In a product like PAB/CTB you need first to design the index, then to make sure it continues to be aligned with the stated objectives.

From the client’s—let’s say, an investor’s—view, he or she will want to know that the index portfolio remains ‘in the money’ with respect to the ultimate, decarbonisation objective. Is it reducing emissions at the rate promised? That’s something we can only answer over time with the right data and the right measurement framework.

Here, I believe that the London Stock Exchange Group (LSEG) measures up well against our competition. We have ample, committed resources to deploy in this area.

Starting with the FTSE4Good index series, launched in 2001, we have been innovating in the SI space for over 20 years. We are able to help clients and industry partners easily transition from traditional indices to environmental, social and governance-focused investment strategies, using the latest metrics and methodologies available.

We use very sound sustainability-focused data environments that we really understand: our green revenues, net zero atlas and implied temperature rise research and data frameworks are good examples. Our involvement in the design of these frameworks helps us make optimal use of the data in index construction.

As SI moves from its origins in equities to encompass other asset classes, such understanding is increasingly important.

Take, for example, FTSE Russell’s sustainable investment fixed income indices. Our Climate World Government Bond indices (Climate WGBI), which are part of this family, incorporate a climate risk assessment into sovereign bond benchmarks, measured across three distinct and quantitative, climate-related pillars: transition risk, physical risk and resilience.

In summary, the increased interest in sustainability results in the acceleration and diversification of index frameworks, with a higher level of sophistication.

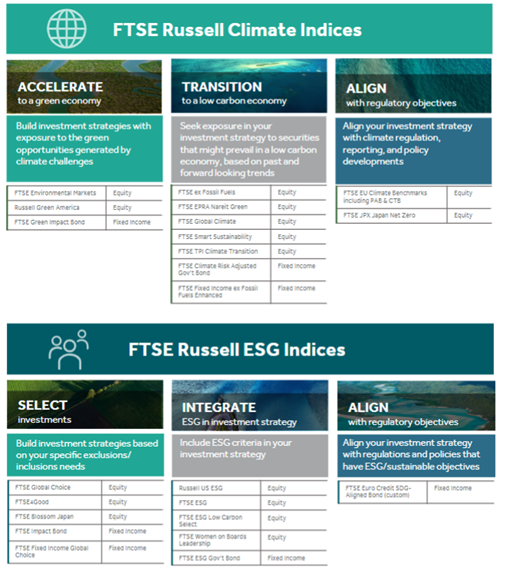

Whatever clients’ sustainability objectives, FTSE Russell offers a comprehensive range of environmental, social and governance (ESG) and climate indices. We provide investors with a broad set of tools to measure and analyse global markets across asset classes, styles or strategies and designed to help investors integrate their sustainability view into their investment strategies.

FTSE Russell Sustainable Investment Index Framework

These indices, covering thousands of companies and the main sovereign issuers globally, are designed to meet diverse investor objectives and themes. Climate is the elephant in the room today, but there is increasing interest in emerging sustainability themes, such as natural capital, biodiversity and the social impact of climate change.

As global head of SI product management at the London Stock Exchange Group (LSEG), I think constantly about how we can mobilise more and different types of data, how we manage the technology stack required to exploit these data in innovative indexes, and how to ensure its accessibility for clients and stakeholders.

Finally, to serve our clients and continue creating innovative indices we need to keep a close eye on the public policy debate and on incoming regulation.

For example, the Securities and Exchange Commission (SEC) has recently proposed new rules on climate change disclosures for US companies. If implemented, the rules will require companies to account for their greenhouse gas (GHG) emissions, the environmental risks they face and the measures they’re taking in response. This is a big deal in the world’s largest equity market.

To bring clarity to such topics we, as a service provider, engage constantly on a number of levels: with the regulator, with clients of course, but also with other stakeholders in this space.

Achieving the critical shift towards sustainability across financial markets—turning talk into action—requires momentum and conviction. LSEG is well-positioned to help our clients make informed decisions.

Discover more about how FTSE Russell is helping bring sustainable investment into the mainstream