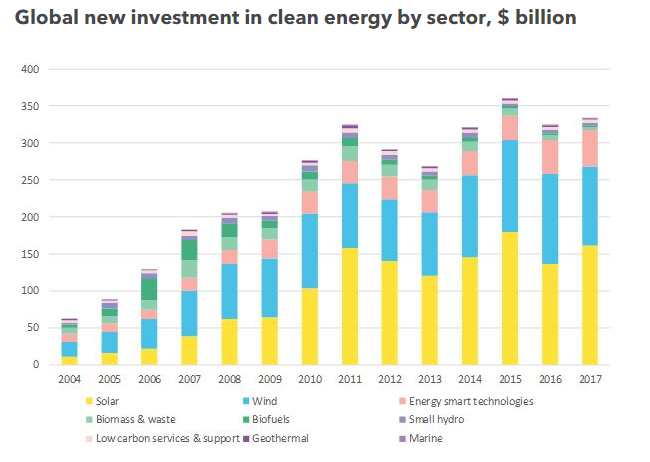

Investment in clean energy hit $333 billion last year

New analysis from Bloomberg New Energy Finance (BNEF) has shown that in 2017 global spending on clean energy projects reached $333.5 billion.

New analysis from Bloomberg New Energy Finance (BNEF) has shown that in 2017 global spending on clean energy projects reached $333.5 billion.

This represents an increase in 3% from the previous year and only 7% short of the $360 billion record set in 2015. The figure also means that cumulative spending on clean energy has reached $2.5 trillion since the start of the decade.

Jon Moore, chief executive of BNEF, commented: “The 2017 total is all the more remarkable when you consider that capital costs for the leading technology – solar – continue to fall sharply. Typical utility-scale PV systems were about 25% cheaper per megawatt last year than they were two years earlier”.

Solar energy remains the dominant force in renewables, and the sector attracted a massive $160.8 billion of total investment in 2017; China again led the way with nearly half of this, at $86.5 billion. 53 gigawatts (GW) of new solar PV capacity was installed in the country.

One of the main reasons for this strong growth was the continued fall in the cost of solar, as well as an increase in projects on rooftops and industrial parks. Justin Wu, head of Asia-Pacific at BNEF, explained that these projects aren’t subject to government quotas; “Large energy consumers in China are now installing solar panels to meet their own demand”, he said.

While Chinese investment dominated the clean energy landscape, accounting for $132.6 billion of the total, the US remained in second with $56.9 billion, up 1% since 2016. This provides some encouragement to observers who thought the sector may have been damaged by the election, and rhetoric, of Donald Trump.

Elsewhere, clean energy spending fell in Japan, the UK and Germany. The 56% decrease in UK investment was “in the face of changes in policy support”, according to analysts.

The report highlighted that wind power was the second largest sector with $107.2 billion, a decrease of 12% from 2016, although a number of multibillion-dollar projects reached initial financing.

Source: Bloomberg New Energy Finance